As financial fraud increasingly shifts to real-time phone manipulation, Google is testing a new in-call protection system that pauses conversations the moment users open banking apps an intervention the company believes could interrupt the psychological tactics that fuel many of today’s most damaging scams.

A Rising Threat and a New Defensive Strategy

Google is broadening its mobile-security efforts with a new in-call scam protection feature that aims to prevent financial fraud as it unfolds. The tool responds to a trend that cybersecurity analysts say is both escalating and evolving: scammers posing as bank representatives, regulators or payment-service agents who pressure victims into revealing sensitive financial information during live calls.

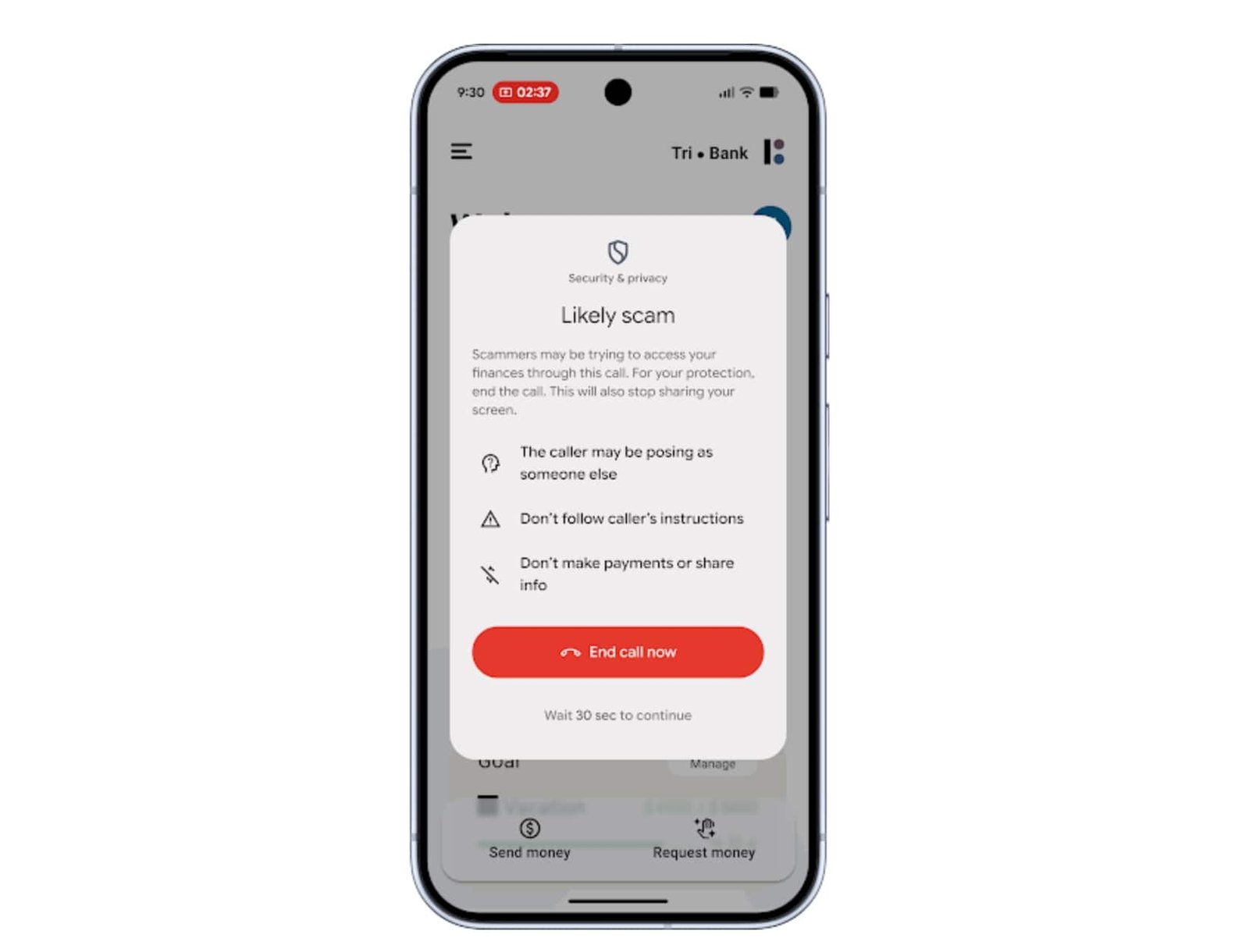

Under the new system, when an Android user opens a financial application while simultaneously speaking with an unsaved number, the device automatically pauses the call for 30 seconds. The interruption is designed to counter social-engineering tactics particularly those that rely on urgency and authority by giving users a moment to recognize the warning signs before screen-sharing or approving transactions.

Engineers familiar with the feature describe it as an effort to build a buffer into a high-stress moment that has traditionally favored fraudsters.

“The pause is intentional friction,” one person said. “The goal is to break the spell of the conversation.”

How the System Works Behind the Scenes

The mechanism operates through Android’s native integration with participating financial institutions. When certain high-risk conditions converge a banking app launches, screen sharing is active, and the caller is not saved in the user’s contacts the device triggers an automated warning.

Users are then offered a single-tap option to end both the call and any active screen-sharing session at once. Google says this design aims to minimize the hesitation that often prevents users from exiting potentially harmful interactions, especially when they believe they are speaking with legitimate authorities.

The detection process occurs entirely on the device, relying on local machine-learning models trained to identify suspicious patterns without transmitting sensitive information to external servers. Company officials say this approach preserves Android’s privacy-first framework while still allowing for real-time intervention.

Pilot Programs and Regional Adaptation

Initial testing began in the United Kingdom, where Google reports that thousands of users were shielded from high-risk interactions that could have resulted in substantial financial losses. The company later expanded its pilots to Brazil and India, followed by U.S. trials involving JPMorganChase and peer-to-peer services such as Cash App.

The staggered rollout reflects a deliberate strategy. Rather than deploying the feature globally in a single step, Google has been working with regional banks and fintechs to understand country-specific fraud patterns. Scams conducted in India, analysts say, frequently exploit screen-sharing apps during impersonation calls; in Brazil, fraudsters often rely on rapid-fire social-engineering methods that unfold within seconds.

Adapting the model to these local nuances, Google argues, is essential to ensuring its broader effectiveness. Early findings appear to support that claim: surveys conducted by YouGov for Google showed that Android users reported 58 percent fewer scam texts compared to iOS users in the same period, a difference Google attributes to its layered security infrastructure.

A Shift Toward Proactive Fraud Prevention

The new feature signals a broader transition in mobile security from reactive responses to breached accounts toward real-time protection during unfolding attacks. Google plans to expand support to more financial platforms based on pilot results, with particular emphasis on vulnerable user groups who face disproportionate fraud exposure.

Industry analysts view the development as an attempt to reshape how smartphone operating systems participate in fraud defense. Instead of merely detecting compromised devices, Google appears increasingly focused on disrupting the conditions that enable scams to succeed in the first place.

The company has also emphasized that the initiative depends on collaboration with banks, payment providers and regulators. The aim, executives say, is to strengthen ecosystem-wide defenses rather than build security features that operate in isolation.