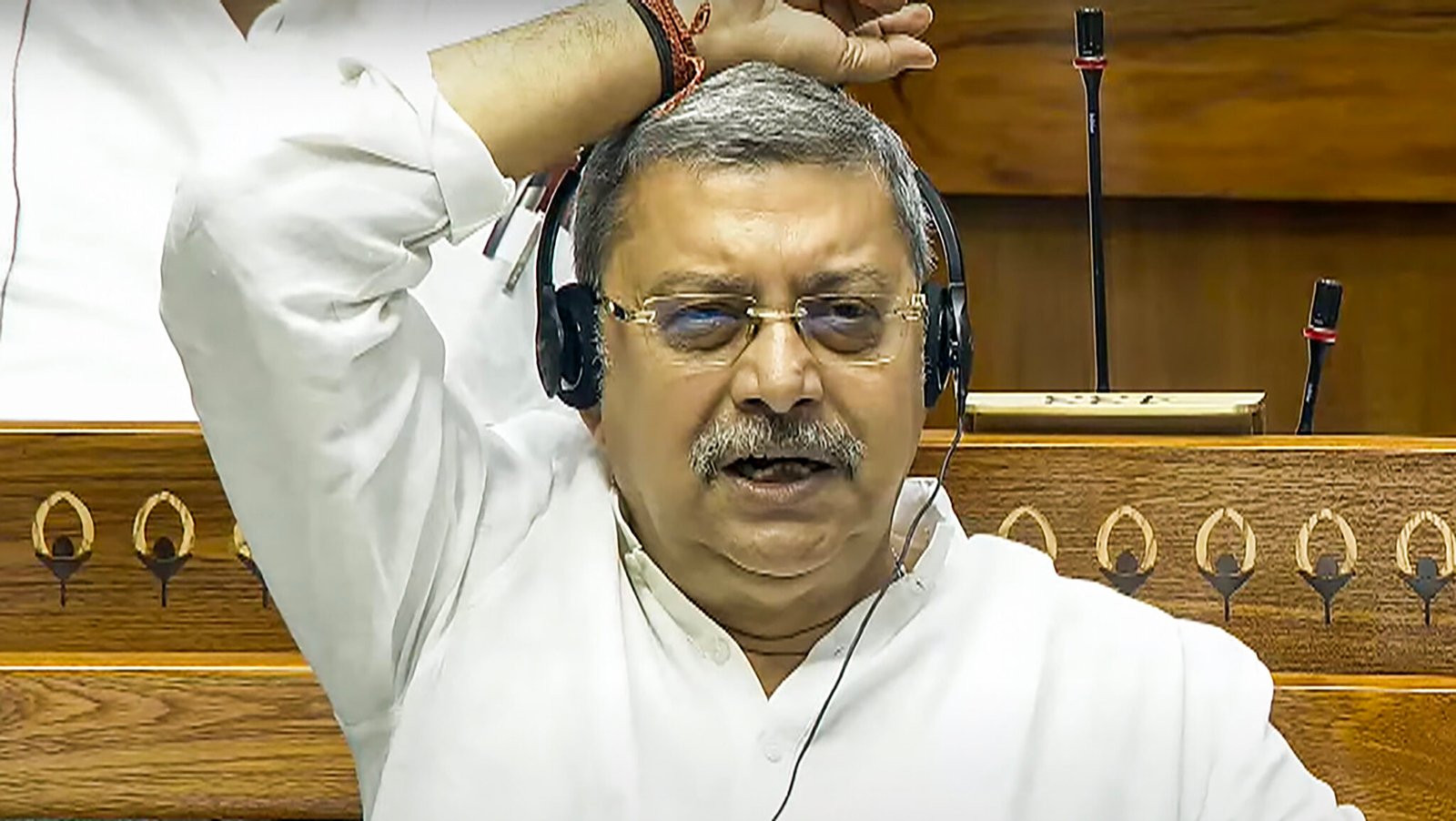

In a striking case of digital fraud, Trinamool Congress MP Kalyan Banerjee — a four-time Lok Sabha member and former party chief whip — has allegedly lost ₹55 lakh after cyber-fraudsters siphoned money from his bank account.

What Happened

Banerjee reportedly discovered that a dormant account at his local State Bank of India (SBI) branch in Kolkata’s Kalighat area, originally used during his MLA tenure (2001–06), was used to channel the fraudulent amount. According to police sources, funds were transferred from his personal SBI account to this dormant account and then withdrawn without his authorisation.

Bank officials have already lodged a formal complaint with the city’s Cybercrime Division to initiate an investigation.

How the Fraud Is Said to Have Worked

Investigators believe that the fraudsters used Banerjee’s photograph and mobile number as part of the scheme — indicating a high level of personal data misuse. The dormant account mechanism suggests possible internal lapses at the bank and raises questions about the safeguards on inactive accounts.

Why This Matters

For a sitting MP and high-profile political figure to become a target underscores how sophisticated online fraud has become — targeting even those who should be cyber-aware. The use of a dormant account highlights a vulnerability often overlooked in bank-compliance regimes: accounts that are inactive but still accessible and can be manipulated.

From a legal perspective, it raises issues about liability and the duty of banks under the Information Technology Act, 2000 and banking regulation frameworks to protect account-holders, especially when personal data is misused.

What Next

Banking officials are being questioned to examine if any internal negligence allowed the dormant account to be used for fraudulent transfers. The Cybercrime Division will attempt to trace the fraudsters, analyse how the mobile number and photograph were misused, and establish the chain of transactions.

Banerjee and his legal team will likely seek recovery of the amount and may investigate whether the bank’s due-diligence or monitoring of the account was adequate.

Key Takeaway for Organisations & Individuals

- Maintain vigilance even over dormant bank accounts: Inactive accounts can be a weak link in financial oversight.

- Personal data (like mobile numbers and photographs) increasingly forms a part of sophisticated fraud schemes – simply protecting passwords isn’t enough.

- Banks and financial institutions must proactively monitor not just active transactions but also the dormant accounts and suspect patterns of transfer and withdrawal.

- Individuals must periodically review all their bank accounts (including inactive ones) and alert banks if unexpected activity is detected.