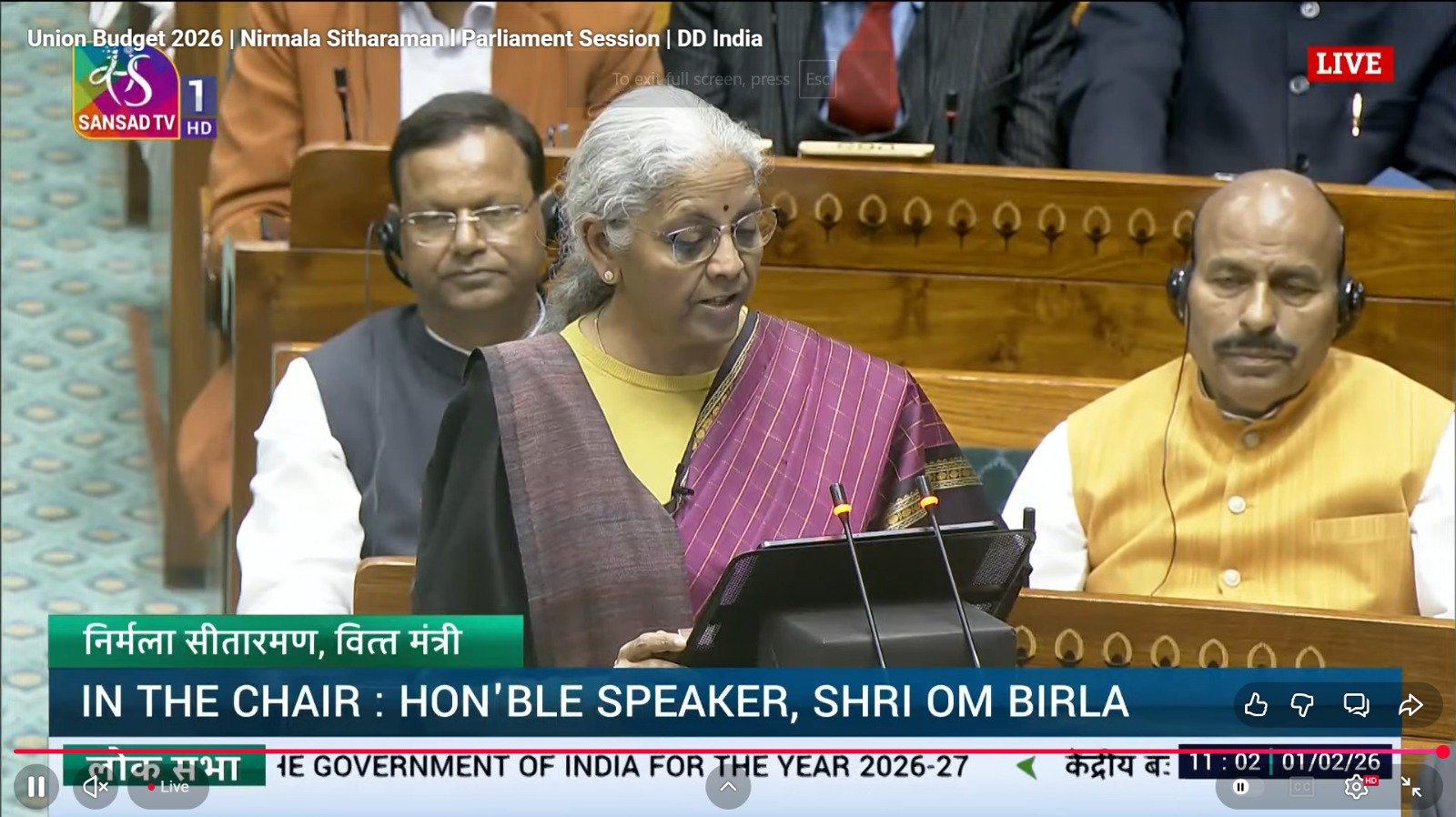

The Union Budget for 2026–27, presented by Nirmala Sitharaman, outlines a calibrated growth roadmap anchored in fiscal discipline, infrastructure expansion, manufacturing depth and sharply targeted sectoral support. Against the backdrop of persistent global uncertainty, volatile commodity prices and slowing world trade, the Budget attempts to strike a balance between sustaining capital expenditure and sticking to a credible fiscal consolidation path, while nudging private investment, exports and domestic capacity creation.

Certified Cyber Crime Investigator Course Launched by Centre for Police Technology

Fiscal discipline stays on track

The Centre has set the fiscal deficit target at 4.3% of GDP for FY27, marginally lower than the 4.4% estimated for the current year. The glide path signals continuity in consolidation without abrupt tightening. Government debt-to-GDP is projected at 55.6%, pointing to a gradual return towards pre-pandemic levels while retaining space for productive public spending.

Capital expenditure scaled up

Public investment remains the principal growth lever. Capital expenditure has been raised to ₹12.2 lakh crore, up from the revised ₹10.9 lakh crore in FY26, representing a 9% year-on-year increase. The emphasis remains firmly on infrastructure-led demand creation, crowding in private investment, improving logistics efficiency and lowering transaction costs across the economy.

A major headline is the announcement of seven new high-speed rail corridors, including key inter-city routes such as Mumbai–Pune and Delhi–Varanasi. These corridors are aimed at transforming passenger mobility, cutting travel time, stimulating regional economies and unlocking new urban clusters along transit routes.

Manufacturing push deepens

The Budget sharpens its focus on domestic manufacturing across strategic and labour-intensive sectors. Priority areas include pharmaceuticals, semiconductors, rare-earth magnets, chemicals, capital goods, textiles and sports goods, reflecting both import substitution goals and export ambitions.

The electronics manufacturing outlay has been doubled to ₹40,000 crore, underlining the push to scale India’s electronics value chain beyond assembly.

The next phase of the semiconductor mission is designed to deepen supply chains, encourage upstream capabilities and reduce dependence on imported components.

A ₹10,000 crore Biopharma Shakti programme has been announced over five years, with ₹500 crore allocated for FY27, aimed at strengthening research, innovation and domestic production.

The Budget also proposes rare-earth corridors, new chemical parks, integrated textile hubs and the revival of 200 industrial clusters to strengthen regional manufacturing ecosystems.

Defence spending sees sharp rise

Defence allocation has climbed to ₹7.85 lakh crore, marking a 15.2% increase over the previous year. Defence capital expenditure alone has risen over 20% to ₹2.31 lakh crore, reinforcing the emphasis on modernisation, indigenous defence manufacturing and long-term capability building. The higher outlay is also expected to support domestic defence suppliers and ancillary industries.

Exports and services get policy backing

The Budget highlights the untapped potential of services exports, particularly in IT-enabled services, professional services and emerging digital segments. Policy support is aligned to free trade agreements, SEZ reforms and ease-of-doing-business measures. Manufacturing-linked exports are expected to benefit from improved logistics, supply chain incentives and trade facilitation initiatives.

Tax and market-related changes

One of the most market-sensitive announcements is a steep hike in Securities Transaction Tax (STT):

- STT on futures increased to 0.05% from 0.02%, a 150% jump

- STT on options raised to 0.15% from 0.1%

The move has been positioned as an attempt to curb excessive speculation rather than raise revenue. However, it has triggered volatility in brokerage, exchange and trading-platform stocks. The Budget also continues nudging corporates towards the simplified tax regime, while tightening select exemptions and strengthening compliance frameworks.

Digital economy and data centres

A standout long-term reform is a 20-year tax holiday for global data centre operators, coupled with a 15% safe harbour on related-party services. These measures are expected to attract large-scale cloud and digital infrastructure investments, reinforcing India’s ambition to emerge as a global data and technology hub.

Healthcare, tourism and MSMEs

Healthcare allocation has crossed ₹1 lakh crore for the first time, with proposals to establish five regional medical tourism hubs in partnership with the private sector. Agriculture, tourism and MSMEs receive targeted support through credit access, infrastructure upgrades, skilling initiatives and technology adoption, rather than broad-based subsidies.

Customs and trade facilitation

Customs duties have been rationalised to support green energy components and critical manufacturing inputs. Baggage and personal import rules have been simplified to ease compliance for international travellers and small importers, reducing procedural friction.

The big picture

Overall, Union Budget 2026 prioritises execution over expansionary populism, betting on infrastructure, manufacturing depth, defence self-reliance, digital capacity and fiscal credibility. While near-term market reactions may remain mixed, the policy direction signals continuity, stability and a long-term growth orientation aimed at building durable economic momentum.

About the author – Ayesha Aayat is a law student and contributor covering cybercrime, online frauds, and digital safety concerns. Her writing aims to raise awareness about evolving cyber threats and legal responses.