Gurugram: TalkCharge, a company founded by Ankush Katiyar, a 2014 graduate from Lovely Professional University according to his LinkedIn, has been at the center of India’s biggest wallet scam, with allegations surfacing of a massive Rs. 5000 crore fraud affecting over 3 million users. The mobile app, which boasts almost 2 million downloads, has received abysmal ratings, reflecting user dissatisfaction and distrust. It is also worth noting that #TalkChargeScam has been trending on X for over a month.

Initially launched as a prepaid payment instrument, TalkCharge promised users lucrative cashback offers, enticing many to invest significant amounts. The company presented seemingly attractive offers, claiming users could earn 10-20 times their investment within 10 months. However, these promises turned out to be part of an alleged Fraudulent scheme.

The company encouraged users to purchase ‘Priority Passes’ and recharge their wallets with substantial amounts, only to find that their money was trapped. Reports indicate that once funds were added to the TalkCharge wallet, users were unable to transfer them back to their bank accounts, leaving them with limited options to use the money for mobile recharges and bill payments. Moreover, TalkCharge imposed a flat 20% convenience charge, further aggravating the situation.

Users seeking assistance have faced additional hurdles as TalkCharge’s helpline numbers have become unresponsive. Frustrated customers report that no one is answering calls, and visits to the company’s offices reveal that they are abandoned, with no employees present to address concerns of the victims.

ALSO READ: ‘Bada Ghotala’ in NEET 2024? Students Claim Mockery of Meritocracy as 8 from Same Centre Get 720/720

‘Threatening’ Legal Notices and RBI’s Intervention

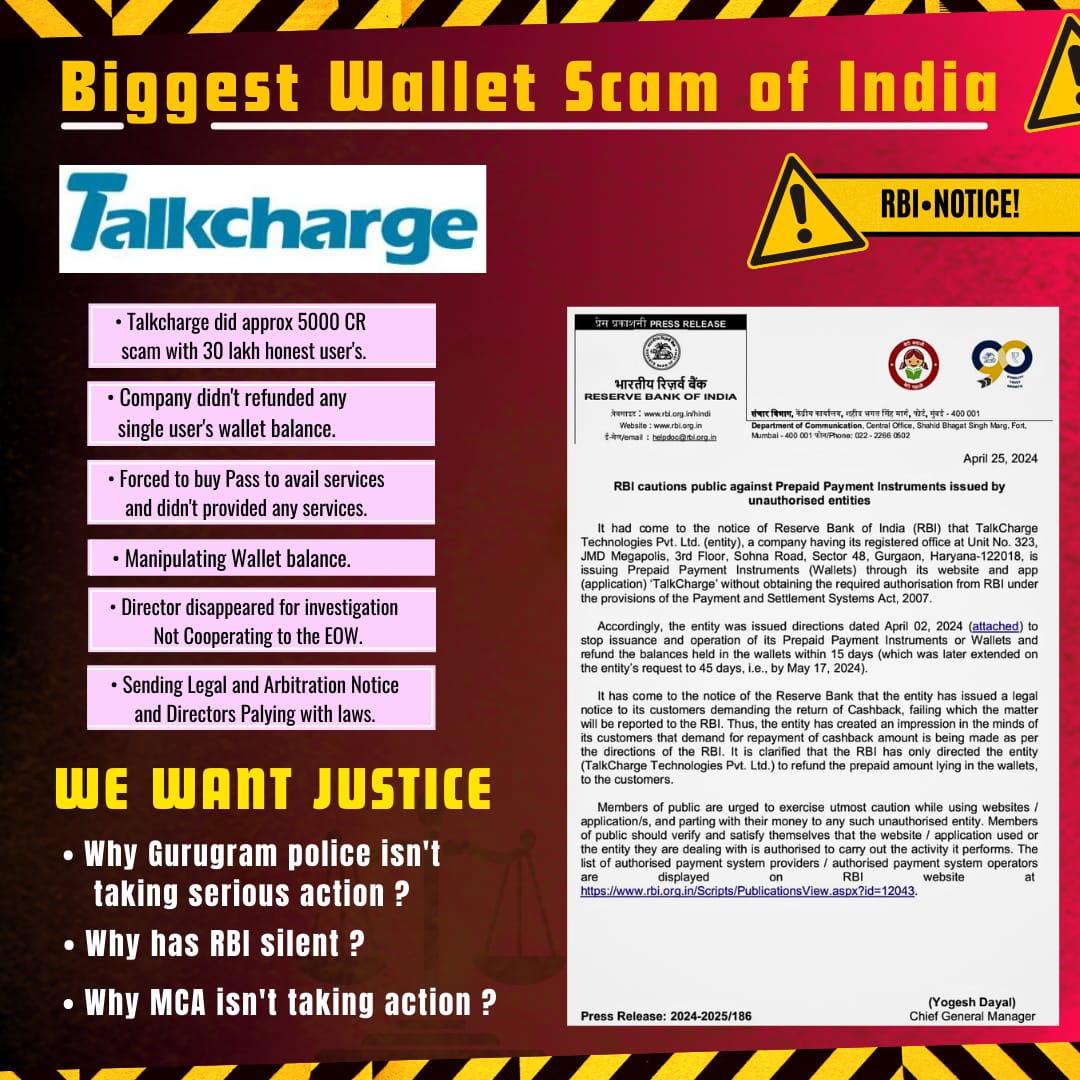

In a shocking move, TalkCharge began sending legal and arbitration notices to ‘threaten’ users, accusing them of misusing cashback offers for commercial purposes. The company even went to the extent of using the Reserve Bank of India’s (RBI) name in these notices until April 22, 2024, creating a threatening environment for users. This led to a public notification by the RBI, warning against the unauthorized operations of TalkCharge and instructing the cessation of its services.

An FIR has been registered by the Economic Offences Wing (EOW) against TalkCharge, yet the progress remains unclear. Adding to the mystery, Ankush Katiyar has reportedly disappeared and is uncooperative with the ongoing investigation. The company’s response to the RBI’s Stop Operation Order highlighted compliance issues, with bank accounts frozen and mobile numbers blocked by the Cyber Cell.

The Human Cost of the Alleged Scam: Lives in Turmoil

The impact of this scam has been devastating. Many users took out personal loans to invest in TalkCharge’s schemes, believing in the false promises of substantial returns. Now, facing continuous calls from recovery agents and mounting debts, some users are on the brink of despair, with the financial strain pushing them towards drastic measures.

The TalkCharge scam raises critical questions about the regulatory oversight and the effectiveness of enforcement agencies. Why is the Gurugram police not taking serious action? Why has the RBI has not initiated serious action? Why isn’t the Ministry of Corporate Affairs (MCA) intervening to protect the public? The victims of the alleged TalkCharge scam deserve justice, and it’s imperative that authorities take swift and decisive measures to address such widespread fraud.

Follow The420.in on

Twitter (X), LinkedIn, and YouTube