In an age where your smartphone might be more conniving than a cunning fox, Truecaller and HDFC ERGO have teamed up to keep digital fraud at bay. The duo has introduced a product dubbed ‘Fraud Insurance’, aiming to arm Indian users with robust protection against the ever-evolving threat of digital communication frauds. With digital financial frauds causing a jaw-dropping loss of Rs 1.25 lakh crore over the past three years, this initiative couldn’t have come at a better time.

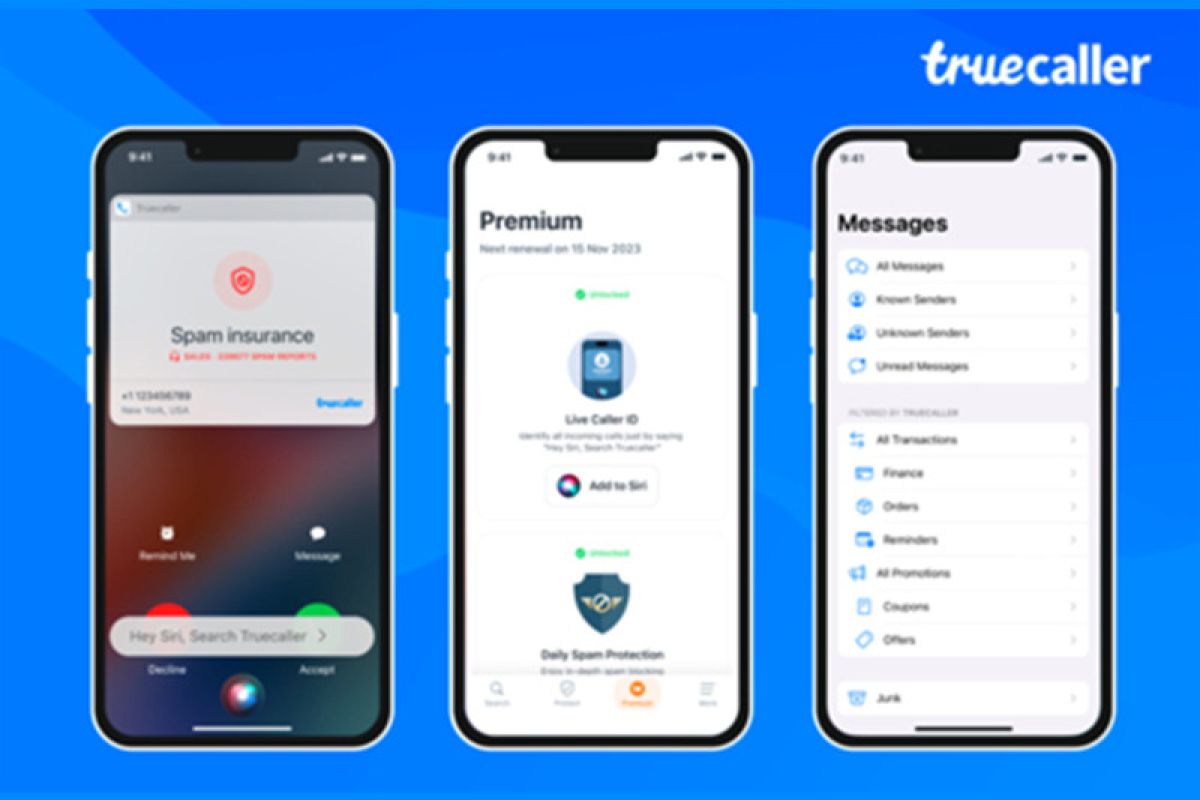

Truecaller, a savior in the digital communication realm, is now flexing its muscles in the financial protection arena. By joining forces with HDFC ERGO, a stalwart in the insurance industry, Truecaller is offering users a safety net against digital skullduggery. The Fraud Insurance provides coverage of up to Rs 10,000, catering to both Android and iOS users across India. While premium subscribers get this as part of their yearly plan, existing users can avail themselves of this protection for free. The best part? Activating this coverage is as easy as pie, right from the Truecaller app.

Rs. 42 Crore Reward for Tips on Lady Cybercriminal ‘Cryptoqueen’ – Submit Yours Now!

Fraud Insurance is not just about financial coverage. It complements Truecaller’s existing suite of security features, adding layers of protection akin to a digital onion. Users will benefit from AI-driven spam blocking, an AI Assistant, and a call scanner designed to fend off threats. And if, by some misfortune, a scam does slip through these defenses, the insurance is there to provide financial reimbursement.

A recent report by the Indian Cyber Crime Coordination Centre highlights the gravity of the situation: digital financial frauds have resulted in a staggering loss of Rs 1.25 lakh crore over the past three years. Truecaller’s Chief Product Officer and MD, India, Rishit Jhunjhunwala, expressed his excitement about this innovative offering, underscoring the company’s commitment to user security and trust.

He remarked, “We empower users with the peace of mind they deserve in today’s complex digital landscape.”

Algoritha Security Launches ‘Make in India’ Cyber Lab for Educational Institutions

Vishal Sikand, Joint President, Commercial Lines, HDFC ERGO, mirrored Jhunjhunwala’s enthusiasm. He noted that the pandemic has fueled the growth of digital mobile payments, inadvertently opening the door for increased digital fraud. Partnering with Truecaller aligns with HDFC ERGO’s commitment to leveraging technology for customer-centric innovations. Their comprehensive insurance, combined with Truecaller’s massive user base, promises to significantly enhance financial inclusion and protection against digital fraud.

Follow The420.in on

Twitter (X), LinkedIn, and YouTube