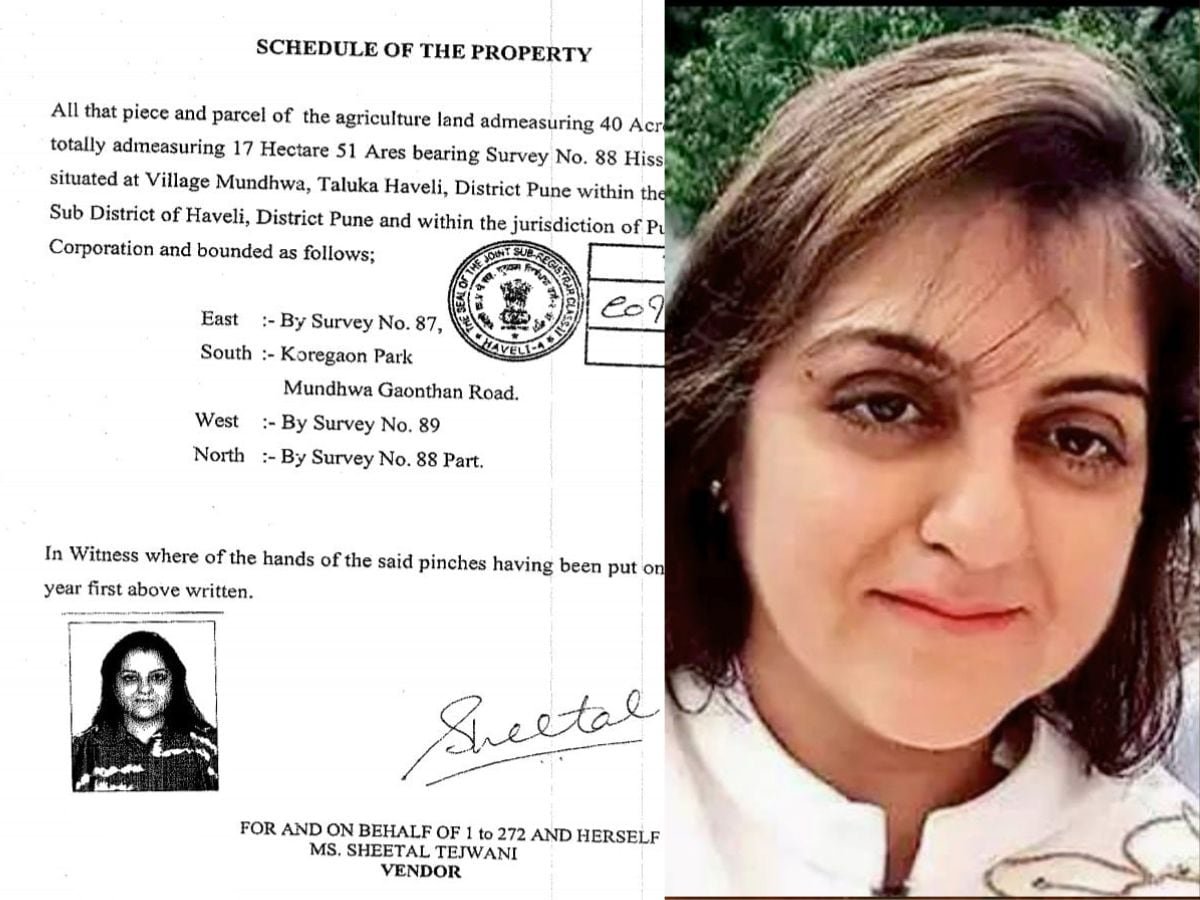

PUNE: The arrest of Sheetal Tejwani has reopened scrutiny of a long-running cooperative bank fraud case in Maharashtra, reviving questions that stretch from disputed loan sanctions to court interventions, regulatory action and parallel criminal investigations

A Case That Refused to Close

In November 2021, the Bombay High Court quashed a first information report filed by Dhanraj Aswani, who had accused officials of Seva Vikas Cooperative Bank of fraudulently sanctioning loans. The order appeared to bring temporary relief to several accused. But in 2023, the Supreme Court of India set aside the High Court’s ruling and directed further investigation, effectively reopening a case that had already traversed years of legal uncertainty.

Final Call: FCRF Opens Last Registration Window for GRC and DPO Certifications

That decision altered the trajectory of the probe. Investigators revisited transactions and loan disbursements that had earlier drawn complaints from depositors and whistleblowers. What followed was a series of arrests and parallel inquiries, as state and central agencies reassembled the paper trail of a bank that once served nearly one lakh depositors through 25 branches across Maharashtra.

Arrests, Loans and the Role of Seva Vikas Bank

After the Supreme Court’s intervention, the Maharashtra Criminal Investigation Department arrested Sagar Suryawanshi, Arhana and Manish Zende, all of whom had taken loans from Seva Vikas Bank. Investigators then sought the custody of Sheetal Tejwani to examine her alleged role in the loan fraud.

The CID told the court that loan amounts were transferred into Arhana’s account at Seva Vikas Bank, and that an entity named “Renuka Lawns,” linked to the transactions, was not registered with the Assistant Registrar of Firms in Pune. According to investigators, although Tejwani’s original loan exposure was ₹7.25 crore, accumulated interest pushed the default amount to ₹20.49 crore.

A special court remanded Tejwani to CID custody for further questioning, allowing investigators to trace the flow of funds and examine how certain loans were sanctioned and subsequently defaulted upon.

Regulatory Intervention and the SIT Probe

The unfolding criminal investigation ran alongside regulatory action. In June 2021, the Reserve Bank of India appointed an administrator for Seva Vikas Bank following multiple depositor complaints filed in 2019 and 2020 and the arrest of four office bearers.

The Maharashtra government also appointed an auditor to examine alleged irregularities in loan disbursements. The auditor’s report, submitted in 2020, prompted the Pimpri Chinchwad police to constitute a Special Investigation Team. The SIT later reported serious irregularities in 124 loans amounting to approximately ₹429 crore, leading to the registration of multiple FIRs related to the fraud.

Parallel Investigations and Expanding Scrutiny

Based on the SIT’s findings, the Enforcement Directorate launched an investigation under the Prevention of Money Laundering Act. The agency seized movable and immovable properties valued at ₹122.35 crore that it said were linked to various accused in the case.

Separately, Arhana was arrested by Pune city police in 2023 for allegedly aiding drug racketeer Lalit Patil’s escape from police custody at Sassoon General Hospital. That arrest added another layer of complexity to an already sprawling investigation.

Tejwani herself was taken into CID custody on January 3 from Yerwada jail, where she had been lodged in connection with the Mundhwa land scam involving a firm in which Parth Pawar, the son of Maharashtra Deputy Chief Minister Ajit Pawar, is a partner. The CID team, led by police inspector S. N. Lahane, produced her before a special court in Pune as investigators continued to piece together the overlapping financial and criminal threads tied to the Seva Vikas Bank case.