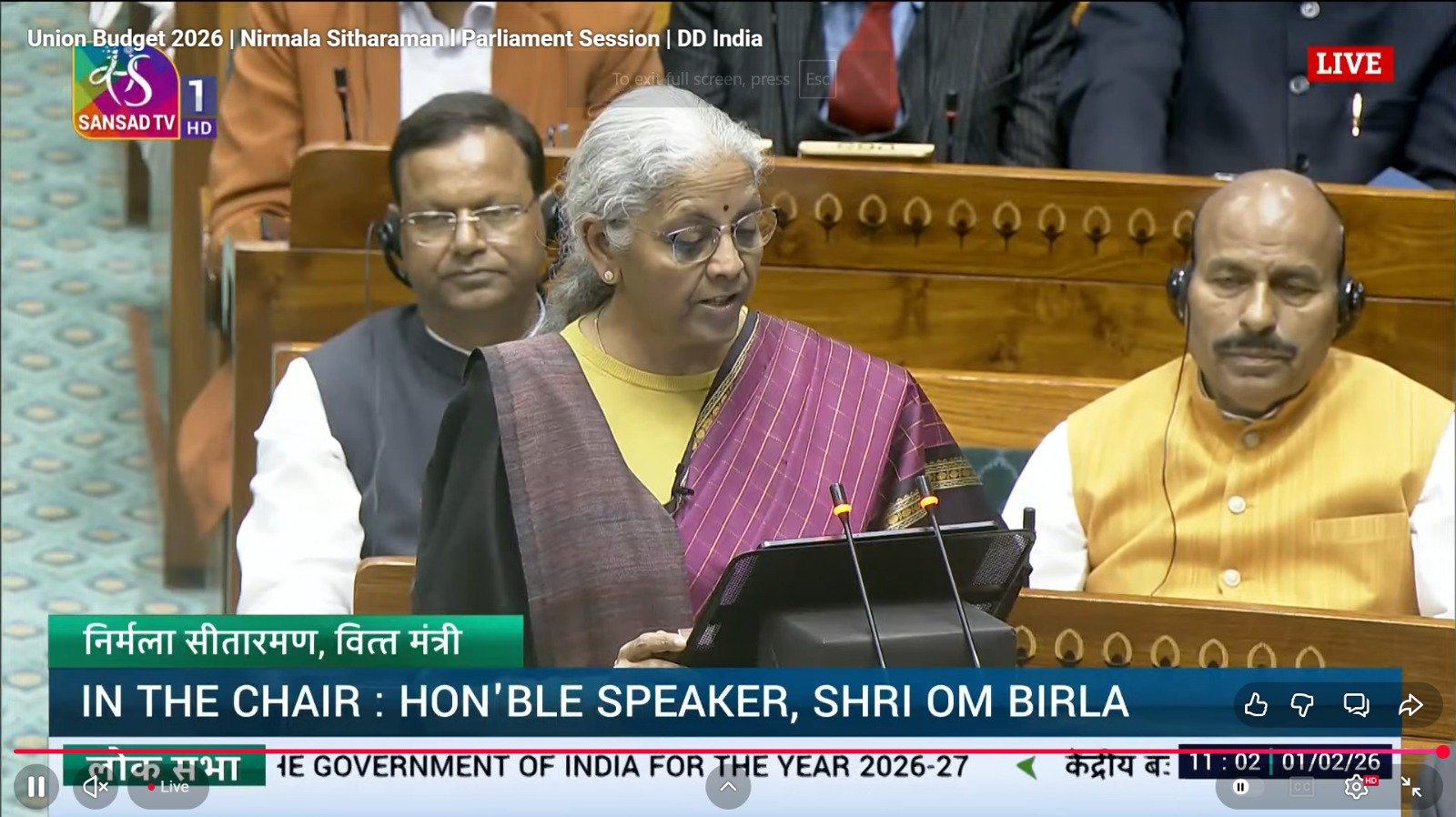

While the Union Budget 2026 did not alter personal income tax slabs, the government has laid the groundwork for a sweeping overhaul of the income tax filing framework. The New Income Tax Act, scheduled to come into force from April 1, 2026, is expected to significantly change how individuals file their Income Tax Returns (ITRs), with simpler rules, redesigned forms and revised compliance timelines.

According to budget announcements, the objective of the new law is to make tax filing easier, more transparent and less litigation-prone, particularly for small and mid-level taxpayers. Alongside the legislation, the government is expected to notify simplified income tax rules and new ITR forms in the coming months.

Certified Cyber Crime Investigator Course Launched by Centre for Police Technology

Here are the seven key changes that taxpayers should be prepared for.

1. New ITR forms to be notified

With the new law coming into effect from April 1, 2026, the government will introduce new ITR forms aligned with simplified tax provisions. These forms are expected to reduce duplication, streamline disclosures and make filing more intuitive for salaried individuals, professionals and small taxpayers.

2. Extended deadline for revised returns

One of the most significant relief measures announced in Budget 2026 is the extension of the revised ITR filing deadline. Taxpayers will now be allowed to file a revised return with a nominal penalty up to March 31, instead of the earlier deadline of December 31 of the assessment year.

This move is aimed at giving taxpayers additional time to correct errors or omissions without facing harsh consequences.

3. No change in ITR-1 and ITR-2 deadlines

The budget has not altered the original filing deadlines for commonly used return forms:

ITR-1 and ITR-2: July 31 (unchanged)

Non-audit business cases and trusts: Deadline extended to August 31The government clarified that the standard compliance calendar for most individual taxpayers will remain stable.

4. Share buyback tax rules tightened

A major policy shift has been announced in the taxation of share buybacks. From April 1, 2026, buybacks will be taxed as capital gains in the hands of shareholders, across all categories.

Corporate promoters: Effective tax rate of around 22%

Non-corporate promoters: Effective tax rate of around 30%The move is aimed at discouraging tax arbitrage and aligning buyback taxation with dividend and capital gains principles.

5. Changes in updated return for loss cases

Under the new framework, taxpayers will be allowed to file an updated return even in cases involving losses—provided the loss amount declared in the original return is reduced.

This provision will apply under both the old and new tax regimes and will take effect from April 1, 2026. The change offers flexibility to taxpayers who may need to correct overstated losses in earlier filings.

6. Automated NIL deduction certificates

To ease TDS-related compliance for small taxpayers, the government has announced a rule-based automated system for issuing NIL deduction certificates.

Under the new scheme, eligible taxpayers will receive certificates automatically, reducing delays, paperwork and dependency on manual approvals from tax authorities.

7. One-time foreign asset disclosure scheme

In a significant relief for small taxpayers with limited overseas exposure, the government has introduced a six-month one-time foreign asset disclosure scheme.

The scheme is targeted at students, young professionals, tech employees and returning or relocating NRIs, allowing them to declare foreign income or assets below a specified threshold without facing harsh penalties.

Focus on simplification

Officials have reiterated that the new income tax law is designed to move away from complex legal language and excessive cross-referencing, making compliance more taxpayer-friendly while maintaining revenue discipline.

Tax experts believe the changes, particularly extended revision timelines and simplified disclosures, could reduce inadvertent non-compliance and litigation.

The government is expected to release draft rules and ITR forms for stakeholder feedback before the new law takes effect next year.

About the author – Ayesha Aayat is a law student and contributor covering cybercrime, online frauds, and digital safety concerns. Her writing aims to raise awareness about evolving cyber threats and legal responses.