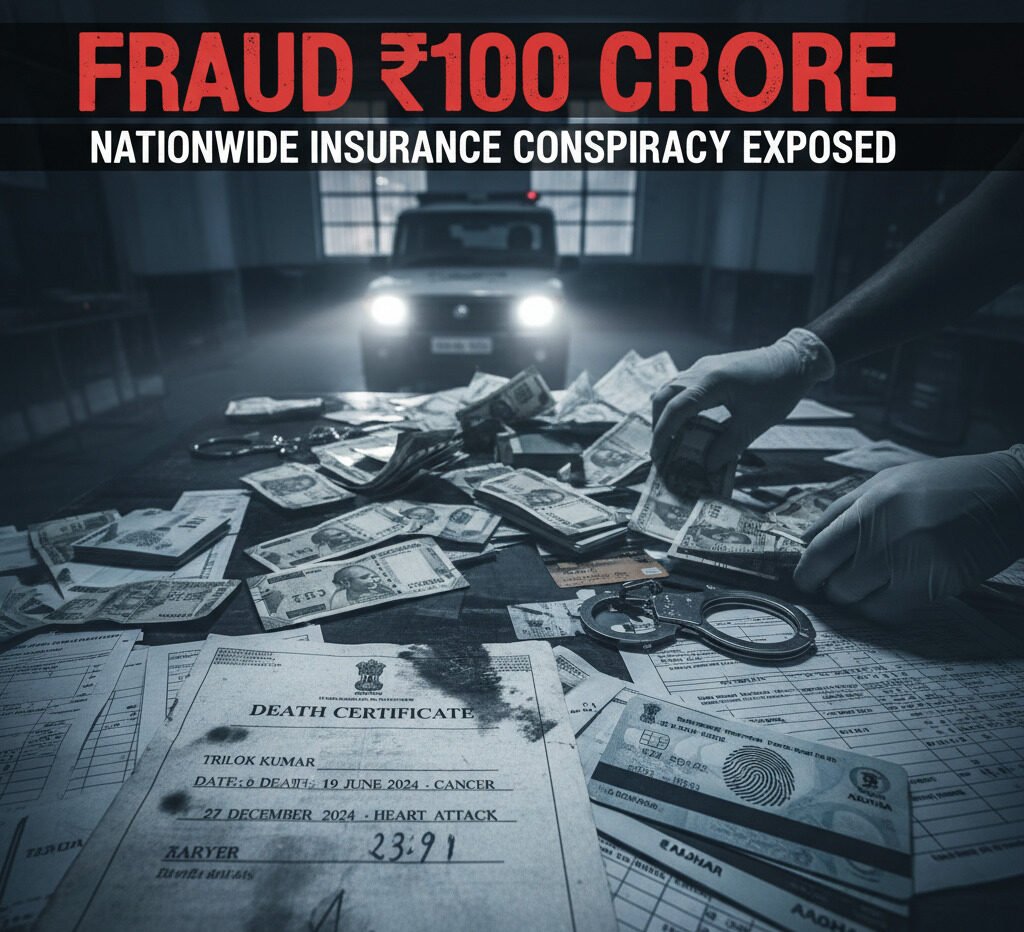

A massive insurance fraud network spanning 12 Indian states has been exposed, revealing the shocking exploitation of vulnerable populations, including the poor, critically ill, and even the deceased. Over ₹100 crore in fraudulent insurance claims has been siphoned off, and police investigations have so far led to 68 arrests, with authorities continuing to trace the full extent of the network.

The case that brought the scheme to light involves Trilok Kumar, a Delhi resident who was astonishingly declared dead twice within six months—first on June 19, 2024, from cancer, and again on December 27, 2024, from a heart attack. Both times, the Delhi Municipal Corporation issued official death certificates, which were then used to secure insurance payouts of ₹20 lakh each. Kumar’s case, while extreme, represents just a fraction of the larger scam that targeted countless other victims.

Car Interception Reveals Trail of Fraud

The investigation gained momentum on January 17, 2025, when Sambhal police intercepted a suspicious Scorpio during routine patrol. Inside, officers found ₹11.45 lakh in cash, 19 debit cards, and over 30,000 insurance-related documents, including falsified medical certificates. The suspects, Omkareshwar Nath and Amit, were identified as former insurance company employees deeply involved in the scam.

FCRF Launches CCLP Program to Train India’s Next Generation of Cyber Law Practitioners

Police discovered that the network preyed on the poor and seriously ill, taking advantage of their vulnerability to secure high-value insurance policies. Many victims were declared dead on paper while still alive, and claims were processed shortly afterwards, funnelling large sums into the hands of fraudsters.

Aadhaar Manipulation and PMJJBY Exploited

The fraud extended to the Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), where perpetrators manipulated ages to make elderly individuals eligible for policies. In one notable example, Pancham Singh, born in 1955, was recorded as being born in 1976 through high-quality iris scans uploaded to the Aadhaar system. This allowed scammers to secure policies and collect payouts soon after the individual’s death, exploiting systemic loopholes.

Local ASHA workers, village leaders, and hospital staff played key roles in facilitating the fraud, providing access to medical records and death certificates, and coercing signatures. Complicit bank officials were also involved, opening accounts, transferring payouts, and collecting commissions of up to 20%.

Fraudulent Deaths and Murder Disguised as Accidents

Some cases involved deliberate homicides staged as accidents. In Badayun, disabled resident Dariyab Jatav was declared dead in a supposed road accident. Post-mortem reports revealed injuries inconsistent with an accident. Investigators later found that his brother orchestrated the killing to claim ₹58 lakh in insurance payouts.

Other victims included poor and critically ill individuals who were persuaded to take policies under false pretences. Some were told the insurance would fund medical treatment, while in reality, their information was used to generate fraudulent claims.

Systemic Exploitation Across 12 States

The fraud network was active in Gujarat, Uttar Pradesh, Assam, and other states, focusing largely on Hindi-speaking regions where language barriers facilitated manipulation. The operation involved multiple layers:

- Insurance agents and investigators are exploiting policy loopholes

- ASHA workers and village leaders are identifying targets and facilitating document collection

- Hospital staff are producing falsified medical records

- Bank employees opening accounts, transferring payouts, and taking commissions

The Human Cost of Fraud

Many victims were unaware of the policies taken out in their names or had no knowledge of claims being filed. Families were threatened or misled, sometimes being told the insurance funds would support treatment, when in reality, the payouts went directly to fraudsters.

Investigators stress that this scam exposed glaring vulnerabilities in the insurance system, from easy manipulation of death certificates to Aadhaar-based identity fraud. Authorities are working to secure all fraudulent transactions exceeding ₹100 crore and prevent similar schemes from recurring.

A Cautionary Tale for Policyholders

This scandal raises serious questions about the safety of insurance systems and underscores the need for stricter verification and oversight. With fraudulent networks exploiting gaps in documentation, Aadhaar authentication, and bank procedures, the case serves as a stark reminder for policyholders and regulators alike: insurance, intended as a safety net, can be manipulated for massive financial gain if oversight fails.