GURUGRAM: Gurugram police have arrested the chief executive of a prominent commercial real estate project after investigators alleged that a single floor was sold multiple times to different buyers, triggering claims of fraud running into hundreds of crores of rupees.

An Arrest in Gurugram’s Commercial Heart

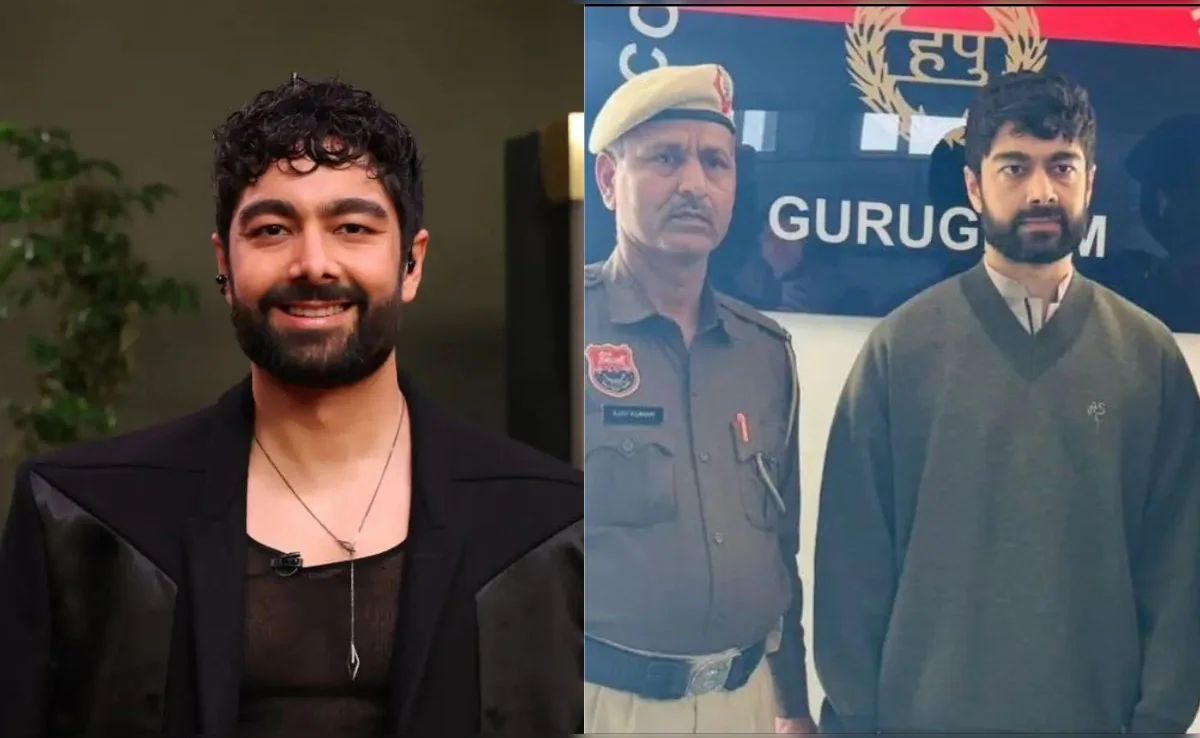

Early this month, officers from the Economic Offences Wing of the Gurugram Police took into custody Dhruv Dutt Sharma, the founder, chief executive and managing director of the 32nd Avenue commercial project, following a complaint that accused him of orchestrating a large-scale real estate fraud. Police said Sharma was arrested after an investigation linked him to the alleged sale of the same commercial floor to more than 25 buyers, collectively involving transactions estimated at nearly ₹500 crore.

Sharma was produced before a local court, which remanded him to six days of police custody. Investigators said his interrogation is ongoing as they seek to map the flow of funds, the structure of agreements signed with investors and the role of associated companies. The arrest follows the registration of a first information report at the Civil Lines police station in Gurugram.

Certified Cyber Crime Investigator Course Launched by Centre for Police Technology

The Complaint That Triggered the Probe

The case originated from a complaint filed in January by Tram Ventures Private Limited, which alleged that in 2021 it had agreed to purchase Unit No. 24—a 3,000-square-foot commercial floor on the first level of the 32nd Milestone complex—for ₹2.5 crore. According to the complaint, the amount was paid and an agreement to sell was executed.

However, the conveyance deed was never registered in the complainant’s name. Subsequent inquiries, the police said, revealed that the same floor had allegedly been sold to at least 25 other individuals between 2022 and 2023. Investigators are examining sale agreements, payment receipts and related documentation to establish how the transactions were structured and whether buyers were aware of overlapping claims on the same asset.

Lease Assurances and Mounting Allegations

Police said the disputed floor was later taken on lease for 30 years from these buyers in the name of another firm, Growth Hospitality Private Limited. Several investors have alleged that they were promised long-term lease rentals, assured demarcation of units and buyback options, arrangements that were presented as a source of stable monthly income.

According to court filings, lease-rental payments allegedly stopped from August 2025. One investor, Arvind Gupta, moved the court seeking the registration of an additional FIR and more stringent action against 32nd Vistas Private Limited, Growth Hospitality LLP and their promoters, including Sharma and two family members. His plea also sought the freezing of bank accounts, attachment of assets, forensic audits of company finances, suspension of passports and the issuance of lookout circulars.

Expanding Legal Scrutiny

On February 5, Judicial Magistrate First Class Devanshi Janmeja issued notice on Gupta’s application and directed the police to submit an action-taken report. The matter is scheduled for further hearing on March 13. In his plea, Gupta alleged that the promoters failed to deposit tax deducted at source from September 2024 and defaulted on GST dues, statutory filings and employee-related contributions such as ESI and provident fund payments.

The complaint also claims that investors were misled with explanations citing “technical issues,” and that fabricated TDS certificates were circulated despite no corresponding deposits appearing in official records. While the plea seeks scrutiny of spending on promotional campaigns and endorsements involving public figures, it clarifies that no allegations have been made against any celebrity.

Gurugram Police have confirmed that multiple FIRs have been registered against the owner and officials linked to the 32nd Avenue project following protests by investors over the alleged non-payment of promised returns. The investigation, officers said, is continuing, with a focus on verifying ownership claims, financial records and the full extent of alleged losses.