In a move aimed at easing compliance stress for taxpayers, particularly individuals and small filers, the Union government on Saturday announced an extension of the deadline for filing delayed income tax returns from December 31 to March 31, subject to payment of a nominal fee, as part of proposals in Union Budget 2026.

The change is expected to provide additional breathing room to taxpayers who miss the original filing deadlines, while also reducing last-minute congestion on tax portals that typically accompanies year-end compliance rushes.

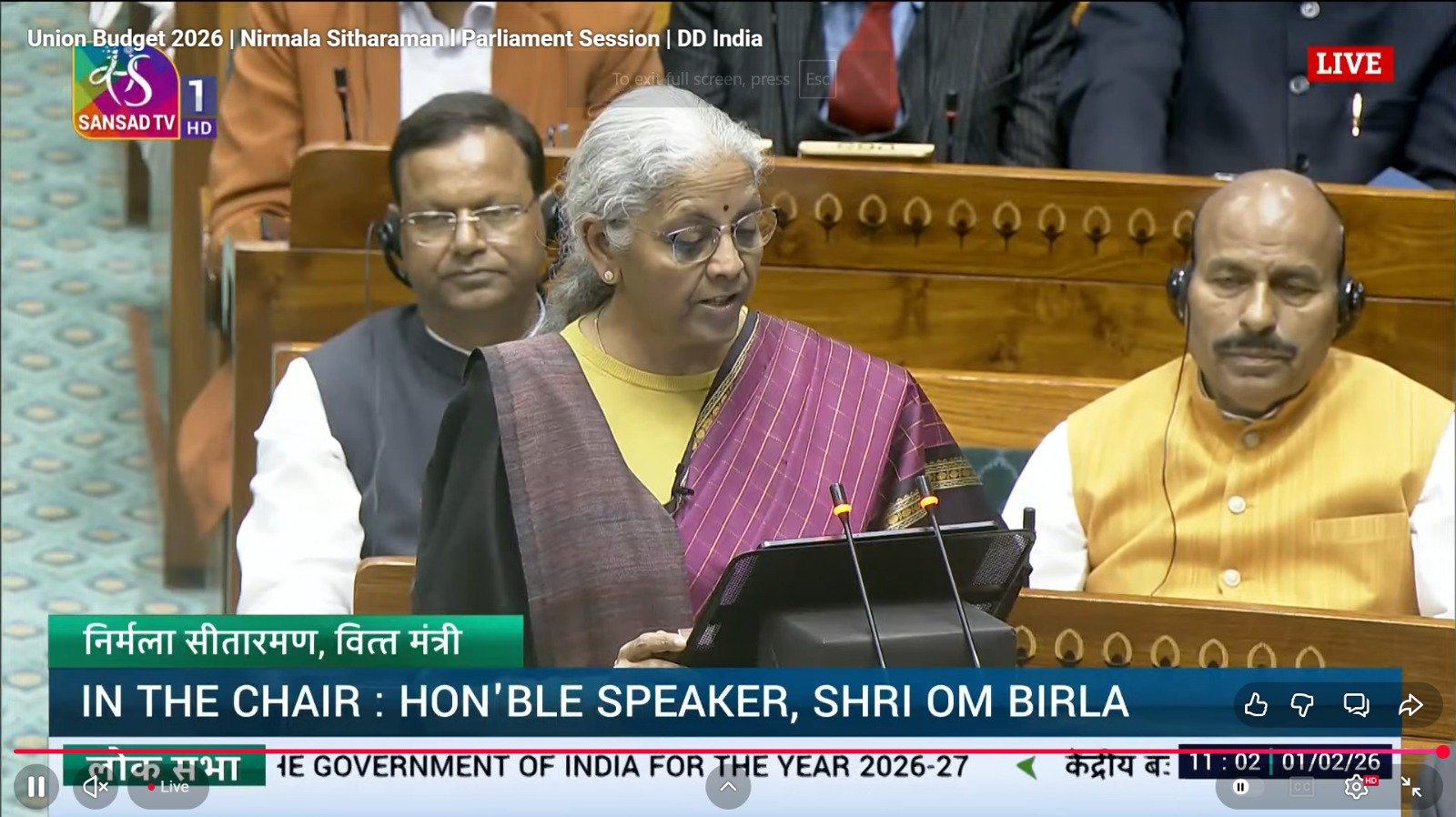

Presenting the Budget in Parliament, Finance Minister Nirmala Sitharaman outlined a broader overhaul of income tax compliance timelines, signalling a shift towards flexibility, automation and rule-based processing for smaller taxpayers.

Certified Cyber Crime Investigator Course Launched by Centre for Police Technology

More time for delayed filers

Under the current framework, taxpayers filing belated returns are required to complete the process by December 31 of the assessment year. The proposed extension to March 31 aligns the belated return deadline with the end of the financial year, a move officials believe will make compliance more practical for salaried individuals, freelancers and small business owners.

The extension, however, will be available only on payment of a nominal late fee, preserving the incentive for timely filing while offering relief to those facing genuine delays due to documentation gaps, reconciliations or technical issues.

Tax experts say the move recognises the growing complexity of income reporting, especially for individuals with multiple income sources, capital gains or foreign asset disclosures.

Staggered timelines to reduce pressure

The Budget also proposes staggered timelines for filing income tax returns, a structural change aimed at easing pressure on both taxpayers and the tax administration system. By spreading filings across defined windows, the government hopes to minimise server overloads and processing delays that have become common during peak filing periods.

Officials indicated that differentiated timelines could be introduced based on taxpayer categories, such as salaried individuals, non-audit cases and small businesses, allowing for smoother processing and fewer technical disruptions.

Automated scheme for small taxpayers

A key reform announced alongside the deadline extension is a new automated scheme for small taxpayers, based on rule-driven processing rather than discretionary assessments. The scheme is intended to simplify return filing, reduce procedural burdens and minimise human interface in routine cases.

Under this framework, straightforward returns with limited complexity would be processed automatically, with system-generated outcomes based on predefined rules. The government believes this will cut down on unnecessary notices, improve predictability and enhance trust in the tax system.

Compliance over coercion

The proposals reflect the finance ministry’s broader approach of encouraging voluntary compliance rather than enforcement-heavy measures. Over the past few years, tax administration reforms have increasingly focused on faceless assessments, digital interfaces and pre-filled returns.

Extending deadlines and introducing automated schemes are seen as continuations of this policy direction, particularly at a time when the taxpayer base is expanding rapidly due to improved reporting and data integration.

Revenue impact and safeguards

While the extension offers relief, officials stressed that safeguards remain in place to prevent misuse. The late fee requirement for delayed filings and existing penalties for misreporting or concealment will continue to apply.

From a revenue perspective, the government expects the impact to be neutral, with improved compliance and reduced litigation offsetting any short-term deferment in collections.

Context of Budget 2026

The income tax proposals come in a Budget that has largely avoided changes to tax slabs, instead focusing on administrative simplification, compliance ease and system efficiency. Analysts say the approach reflects a preference for stability in personal taxation while fine-tuning processes to make compliance less burdensome.

For millions of taxpayers who struggle with tight deadlines and evolving disclosure requirements, the extension to March 31 is likely to be among the most immediately felt relief measures announced in Budget 2026.

As implementation details are rolled out in the coming months, attention will turn to how effectively the staggered timelines and automated scheme are executed—and whether they succeed in delivering a smoother, less stressful tax-filing experience.

About the author – Ayesha Aayat is a law student and contributor covering cybercrime, online frauds, and digital safety concerns. Her writing aims to raise awareness about evolving cyber threats and legal responses.