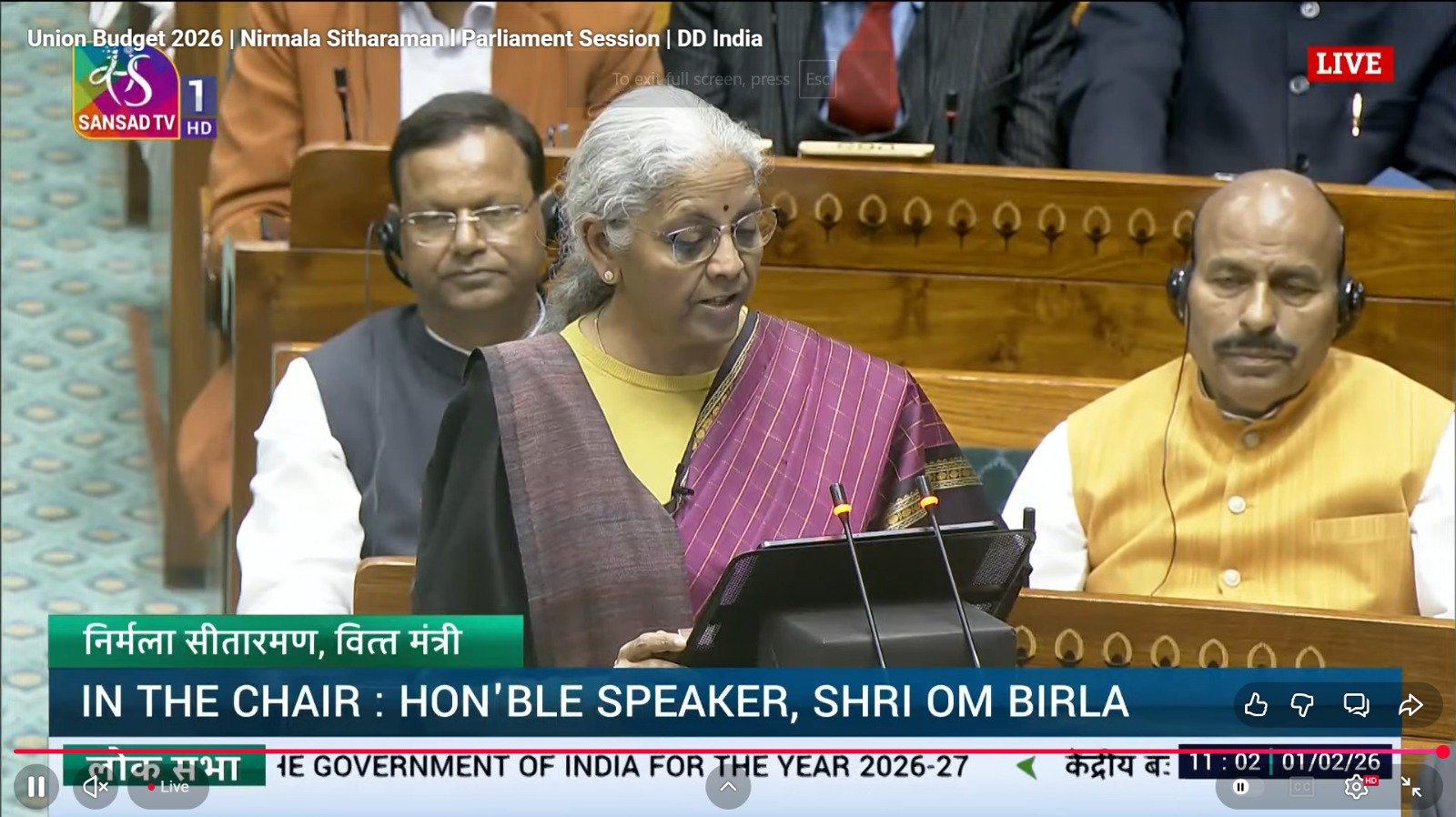

New Delhi: Finance Minister Nirmala Sitharaman on Sunday presented the Union Budget 2026–27, making history as the first Union Budget to be tabled on a Sunday. It was also Sitharaman’s ninth consecutive budget under Prime Minister Narendra Modi, signalling continuity in the government’s long-term digital and economic vision.

At the heart of Budget 2026 is a decisive push to position India as a global hub for data centres, cloud infrastructure, and IT services, backed by long-term tax certainty and simplified compliance norms.

Tax Holiday Till 2047 for Data Centres

In a move aimed squarely at attracting global technology majors, the Finance Minister announced a tax holiday till 2047 for foreign companies setting up cloud and data centre facilities in India. The incentive is expected to accelerate investments in hyperscale data centres, artificial intelligence infrastructure, and cloud computing ecosystems.

Policy watchers say the long time horizon of the tax holiday sends a strong signal of stability to global investors, especially at a time when countries are competing to host data, AI workloads, and digital infrastructure.

Safe Harbour Boost for Data and IT Services

To reduce regulatory friction for multinational IT companies, the Budget introduced a 15 percent safe harbour margin on cost for related-party data services. The measure is expected to lower transfer pricing disputes and improve ease of doing business for global technology firms operating captive data centres, global capability centres, and shared service hubs in India.

IT Services Unified Under One Category

Highlighting India’s dominance in the global IT services market, Sitharaman told Parliament that India is a global leader in software development services, IT-enabled services, knowledge process outsourcing, and contract R&D related to software development.

“These segments are closely inter-linked,” the Finance Minister said, announcing that all such activities will be clubbed under a single category—Information Technology Services.

A common safe harbour margin of 15.5 percent will now apply across the IT sector, simplifying compliance and replacing multiple classifications that often led to ambiguity and litigation.

India is a global leader in software development services, IT enabled services, knowledge process outsourcing services and contract R&D services relating to software development

These business segments are quite inter-connected with each other. All these services are proposed to… pic.twitter.com/t7Vbc0RmZw

— PIB India (@PIB_India) February 1, 2026

Ritvik Dashora, CFA, CEO of Tradomate, said the proposal marks a clear shift in how India wants to be seen in the global digital economy.

“The Budget’s proposal to offer a tax holiday till 2047 for foreign cloud firms using India-based data centres signals a clear strategic push. The government is positioning India not just as a digital consumption market, but as a global backend for cloud and AI infrastructure,” Dashora said.

He noted that data centres are capital-intensive assets with long gestation periods, often taking years to break even. “Policy certainty over two decades materially improves project returns. That could make India more competitive with established hubs like Singapore and Ireland in attracting hyperscalers and global cloud players,” he added.

At the same time, Dashora pointed out that the policy includes built-in guardrails. “Routing Indian customers through domestic resellers and a 15% safe harbour for related-party services aim to reduce transfer pricing disputes while ensuring revenue leakage is limited,” he said.

“Overall, this is a structural FDI play rather than a short-term tax giveaway—aimed at building a durable moat for India in the global data economy and attracting long-term capital into digital infrastructure.”

What This Means for the IT and Digital Economy

The data centre and IT-focused measures in Budget 2026 indicate:

- A strategic push for large-scale data centre and cloud investments

- Support for India’s ambition to become a global digital infrastructure and AI hub

- Greater tax clarity for IT services, shared services, and contract R&D

- Lower compliance risks for multinational technology companies

Long-Term Digital Play

With long-term incentives for data centres and a unified tax framework for IT services, Budget 2026 reinforces the government’s intent to make India the backbone of global digital operations. Industry experts believe the measures could unlock sustained foreign investment, create high-value tech jobs, and strengthen India’s role in the global data and cloud economy over the next two decades.