MUMBAI: A retired professional in Mumbai lost nearly ₹10 crore after a sophisticated online network impersonated a major brokerage firm, using fake trading apps, WhatsApp groups, and fabricated identities. The case, now under cyber-police investigation, reveals a troubling evolution in investment fraud in India’s financial capital.

The First Contact: A Routine Message That Shifted Into a High-Stakes Fraud

In June 2025, a 65-year-old retired professional from Mumbai’s Mulund area received what seemed like an innocuous WhatsApp message. The sender identified herself as Suman Gupta, an “admin” from Anand Rathi Shares & Stock Brokers Ltd., one of India’s most recognised securities firms.

The complainant, who once served as Head of Admin and Industrial Relations at a Mumbai-based corporation and now works as a legal consultant, was told about a new trading opportunity available through an app called “AR Trade Mobi.” To build credibility, Gupta forwarded a registration link and requested PAN and personal details under the guise of KYC verification.

Within weeks, the invitation appeared increasingly professional: market updates, investment tips, IPO information — all delivered with an air of authority. Unbeknownst to the complainant, the carefully constructed digital scaffolding was part of an elaborate scam.

The Illusion of Returns: Inside a Fake Financial Ecosystem

After completing the registration, the complainant was added to a WhatsApp group titled “Anand Rathi VIP 12.” Multiple participants — allegedly posing as financial experts — began sharing investment strategies and screenshots of high returns.

The group mimicked the tone, jargon, and behaviour of legitimate wealth managers. It produced a convincing stream of IPO alerts, mutual fund commentary, and tailored advice. The fake app itself displayed charts, profit indicators, and dashboards that mirrored established trading platforms.

The performance on the app was engineered to inspire confidence. Each investment the victim made appeared to generate generous returns. Encouraged by what he saw, he gradually began depositing larger sums.

Between June and November 2025, the victim transferred ₹9,94,76,958 across multiple bank accounts, believing the funds were being used for IPO bidding and mutual fund investments. The activity logs and “profit statements” visible in the app were updated regularly, sustaining the illusion of a flourishing portfolio.

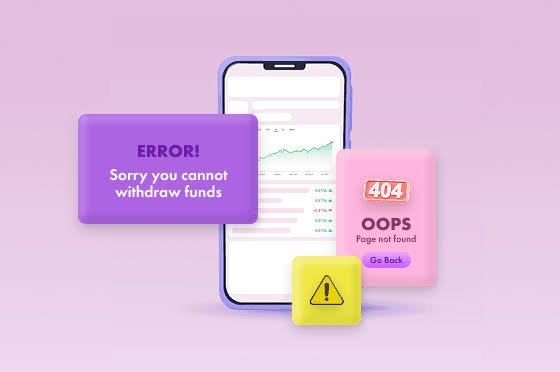

The Collapse of Trust: When Withdrawals Failed

The façade cracked only when the complainant attempted to withdraw his returns. Every transaction attempt failed. Customer support — operated by the fraudsters — attributed the block to “technical issues” and demanded additional payments to cover taxes and commissions.

As the excuses piled up, the complainant grew suspicious. He visited the actual Anand Rathi office in Malad (East), seeking clarity.

There, company officials confirmed that:

-

No employee named Suman Gupta worked with them.

-

No app called “AR Trade Mobi” was associated with the organisation.

-

No authorised WhatsApp groups operated under the company’s name.

The confirmation delivered a jarring truth: he had been ensnared in a meticulously designed fraudulent operation.

The Investigation Widens: Tracing the Network Behind the Scam

Based on the complaint, the East Region Cyber Police Station registered an FIR against ten unidentified individuals under the Bharatiya Nyaya Sanhita (BNS) and the Information Technology Act.

Police officials say efforts are underway to trace the money trail across the various mule accounts used in the laundering process. The operation reportedly overlaps with other ongoing investigations into organised cybercrime cells operating out of multiple states.