FLORIDA: He was 23, living in the United States on an overstayed student visa, and making dozens of trips to elderly Americans’ homes to collect what prosecutors say were their life savings — in cash and gold.

In January, federal authorities announced that Atharva Shailesh Sathawane had been sentenced to 18 years in prison for his role in what they described as an international fraud scheme that preyed on older Americans and moved millions of dollars across state lines and borders.

The case, brought in the Northern District of Florida, drew together local and federal investigators and exposed a network that, officials said, relied on fear, urgency and the portability of gold.

A Courier in a Cross-Border Scheme

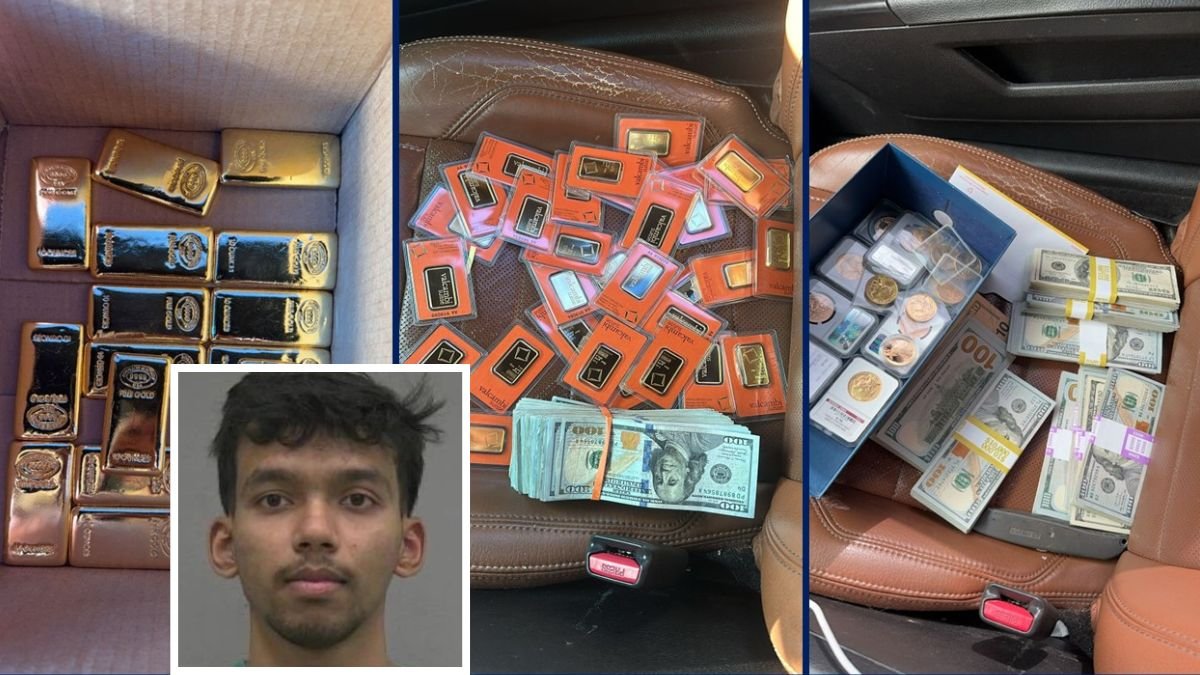

According to the Justice Department, Mr. Sathawane served as a courier in a conspiracy that targeted elderly victims, persuading them to liquidate retirement accounts and convert their savings into cash or gold. Prosecutors said he would then retrieve the assets in person and deliver them to co-conspirators.

Between the summer and fall of 2025, Mr. Sathawane made at least 33 trips over a four-month period to collect money and gold from victims, primarily in Florida. Court records and forensic analysis of his mobile phone showed that while he operated largely out of Florida, the scheme extended to Pennsylvania, Virginia, New Jersey and New York.

Certified Cyber Crime Investigator Course Launched by Centre for Police Technology

In total, officials said, Mr. Sathawane personally took and laundered $6,615,484.66 in cash and gold from elderly victims. He also attempted to collect an additional $1,363,395.98 in gold from two others. Those efforts were interrupted — first by a concerned friend of a victim, and later by law enforcement.

The broader conspiracy, according to the Justice Department’s formal statement, involved individuals operating from India, underscoring what authorities described as an international fraud operation with domestic couriers.

The Moment the Scheme Unraveled

The fraud began to unravel when one elderly victim grew suspicious and reported the matter to authorities. Law enforcement launched an undercover operation.

At one point during the investigation, Mr. Sathawane was taken into custody as he arrived at a victim’s residence to collect more gold. A search of his phone, prosecutors said, confirmed his connection to the wider fraud network.

Ron Loecker, Special Agent in Charge of IRS Criminal Investigation in the Florida Field Office, said in a statement that the defendant’s actions had “robbed victims of their life savings and financial security.” He added that the case demonstrated the impact of cooperation between local and federal agencies in dismantling networks that prey on vulnerable populations.

FBI Jacksonville Special Agent in Charge Jason Carley issued a separate warning, emphasizing that instructions to purchase gold and hand it over to a stranger are not investments but scams. In Florida alone, he noted, victims lost more than $33 million last year to gold bar schemes.

A Pattern Targeting the Elderly

Prosecutors said the scheme followed a consistent pattern. Elderly citizens were convinced to withdraw funds from retirement accounts and convert them into cash, gold or both. Mr. Sathawane would then approach each victim to collect the assets in person, acting as the courier for the operation.

According to court documents, he was convicted in November 2025 of conspiracy to commit wire fraud and conspiracy to commit money laundering. Assistant United States Attorney Adam Hapner prosecuted the case.

Authorities said that at the time of his sentencing, Mr. Sathawane, 23, was also found to have been in the United States unlawfully after overstaying his student visa.

Sentencing and Broader Implications

On Jan. 26, 2026, the U.S. Attorney’s Office for the Northern District of Florida announced Mr. Sathawane’s sentence: 18 years in federal prison.

Officials described the sentencing as a measure of accountability for a scheme that, in their words, preyed on trust and fear. They praised the victims who came forward, saying their reports helped bring the operation to light and led to Mr. Sathawane’s arrest.

The case resurfaced in public attention in recent days after a social media post circulated details of the Justice Department’s press release. But in court filings and statements, prosecutors focused on the victims — retirees who, authorities said, were persuaded to part with their savings under the belief that they were protecting their assets.

The investigation, officials said, remains a reminder of how fraud schemes can span continents while relying on face-to-face encounters at the front doors of American homes.