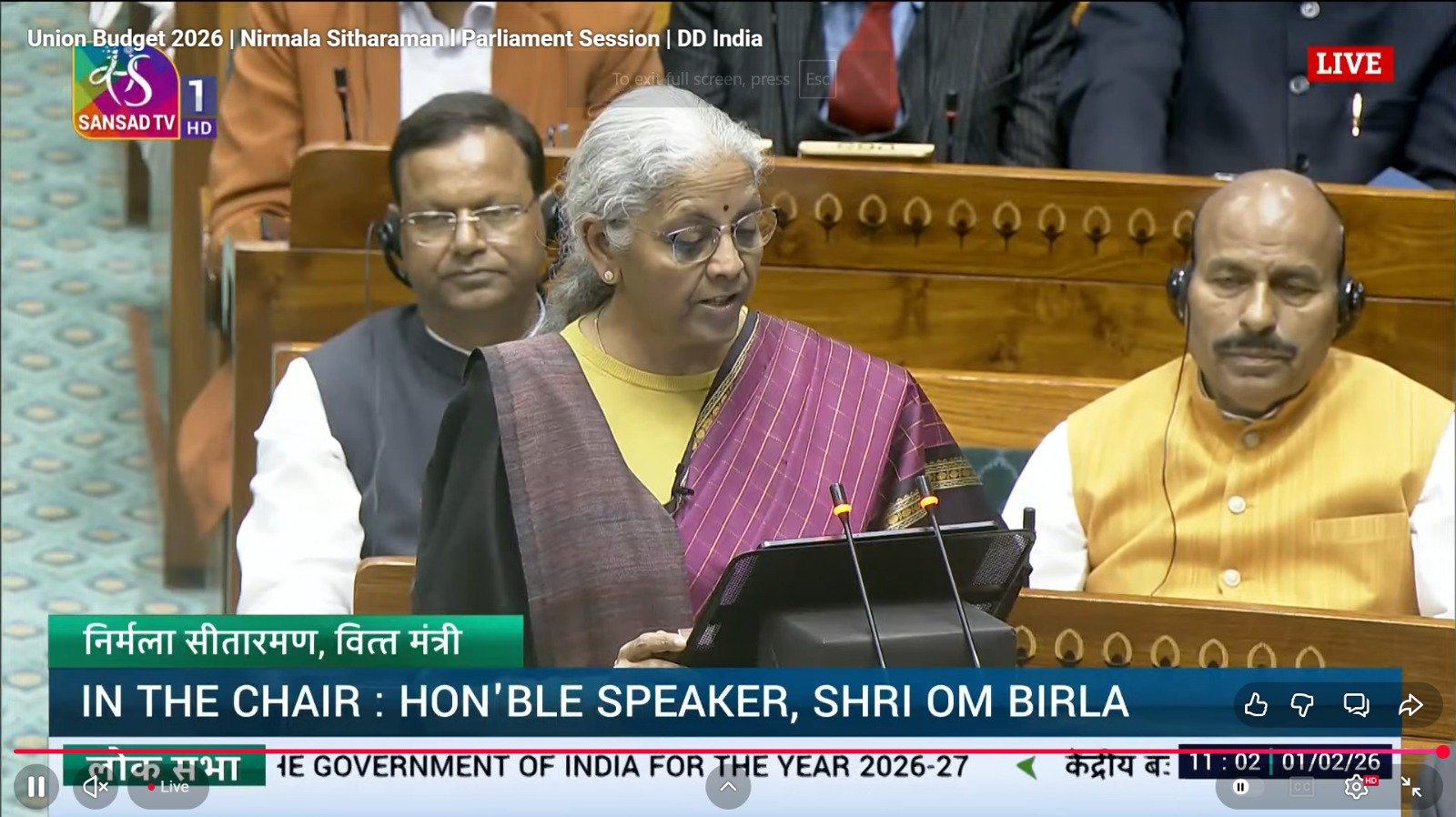

The Union Budget for 2026–27 has laid out an expansive roadmap aimed at sustaining economic momentum amid global uncertainty, with a sharp focus on internal security, infrastructure-led growth and the digital economy. The Ministry of Home Affairs emerged as a major beneficiary, receiving an allocation of ₹2.55 lakh crore, marking an increase of over 9% compared to the previous year.

The enhanced outlay signals continued emphasis on internal security, border management and intelligence capabilities, even as the government balances fiscal consolidation with growth priorities. Within the Home Ministry’s expanded budget, allocations for intelligence, border infrastructure and upcoming national exercises are expected to see notable gains.

Certified Cyber Crime Investigator Course Launched by Centre for Police Technology

Capex scaled up, growth engine intact

At the macro level, the Budget reaffirmed the government’s commitment to public capital expenditure, raising the outlay to ₹12.2 lakh crore from ₹11.2 lakh crore last year. Capital spending now accounts for around 4.4% of GDP, among the highest levels in a decade, underscoring the central role of infrastructure in driving medium-term growth.

Spending priorities include freight corridors, high-speed rail links, urban infrastructure, waterways and logistics, with a clear push towards improving connectivity in Tier-2 and Tier-3 cities. The Budget also outlined plans for new industrial corridors and city-economic regions, designed to act as growth clusters over the coming decade.

Cloud services get long-term tax relief

One of the most closely watched announcements was a tax holiday extending till 2047 for foreign companies offering cloud services using Indian data centres. The move is aimed at positioning India as a global hub for data storage, processing and digital services, while ensuring that services to domestic users are routed through Indian entities.

Industry experts said the measure could accelerate large-scale investments in data centres, generate high-skilled jobs and deepen India’s role in global digital supply chains. The policy also aligns with broader efforts to localise data infrastructure while remaining open to global technology firms.

Fiscal discipline maintained

Despite higher spending, the Budget retained a cautious fiscal stance. The fiscal deficit for 2026–27 has been pegged at 4.3% of GDP, marginally lower than the 4.4% projected for the current year. The glide path reflects a gradual approach to consolidation, even as global risks—from trade disruptions to geopolitical tensions—continue to weigh on outlooks.

Total expenditure for the year has been set at ₹53.5 lakh crore, while non-debt receipts are estimated at ₹36.5 lakh crore. The government also reiterated its intent to keep public debt on a declining trajectory relative to GDP over the medium term.

No income tax slab changes, new law timeline set

The Budget refrained from altering personal income tax slabs, maintaining status quo for individual taxpayers. However, a major structural shift was announced with the new Income Tax law scheduled to come into effect from April 1, 2026, aimed at simplifying compliance and reducing litigation over time.

In indirect taxes, the Budget focused on rationalisation—cutting duties on select inputs, easing customs processes and extending relief for critical sectors such as clean energy, aviation components and medical imports.

Sectoral signals

Beyond security and infrastructure, the Budget flagged support for manufacturing, MSMEs, tourism, agriculture and emerging technologies. Announcements related to rare-earth corridors, biopharma manufacturing, semiconductor ecosystems and service-sector reforms point to a long-term strategy anchored in supply-chain resilience and value addition.

Bottom line

The Union Budget 2026–27 presents a calibrated mix of growth push and fiscal restraint, reinforcing security and infrastructure while betting heavily on India’s digital future. With higher allocations for internal security, sustained capex momentum and incentives for global cloud players, the Budget positions itself as a long-horizon blueprint rather than a short-term stimulus. How effectively these ambitions translate into execution will determine whether the growth narrative holds firm in an increasingly volatile global environment.

About the author – Ayesha Aayat is a law student and contributor covering cybercrime, online frauds, and digital safety concerns. Her writing aims to raise awareness about evolving cyber threats and legal responses.