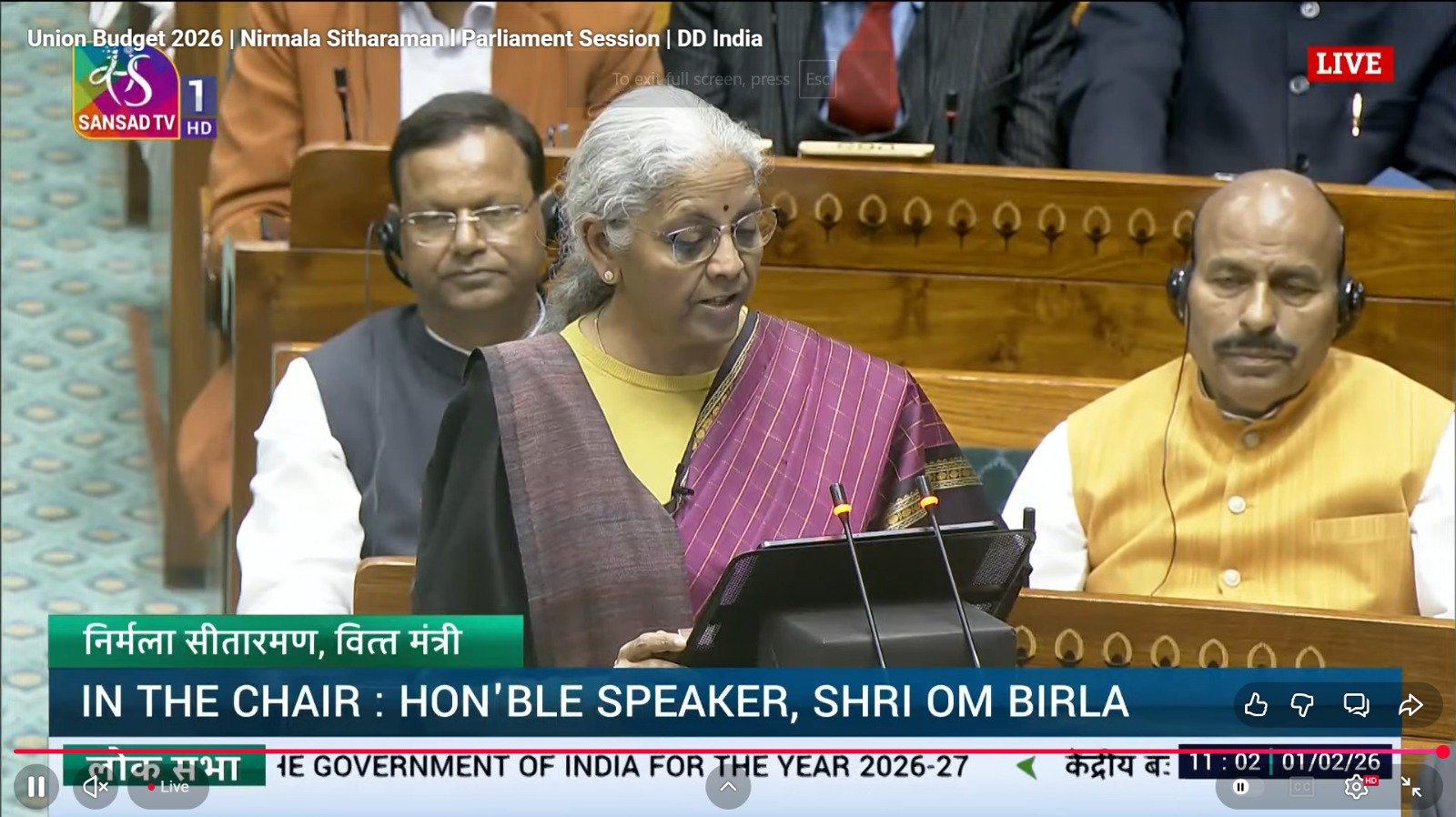

The Union Budget for 2026–27 has redrawn the price map for Indian consumers, delivering targeted relief across healthcare, electronics, renewable energy and sports goods, while tightening the tax screw on alcohol, tobacco, luxury imports and high-risk trading. Through a sweeping rejig of customs and excise duties, the government has sought to push domestic manufacturing, lower treatment costs and advance clean-energy adoption, even as it mobilises additional revenue from “sin goods” and speculative segments.

Healthcare relief leads the list of price cuts. In a move welcomed by patients and hospitals alike, customs duty has been fully removed on 17 life-saving cancer medicines. The exemption is expected to materially reduce therapy costs for critical patients and improve access to advanced treatments, particularly for imported formulations that previously attracted significant levies.

Electronics and appliances should also see price easing. The budget extends duty relief to select components and capital goods used in mobile phone manufacturing, a step aimed at deepening value addition in India. Industry executives expect this to translate into lower prices for new smartphones over the coming months as supply chains recalibrate. Alongside phones, certain parts used in microwave ovens have been granted lower import duties, potentially bringing down prices of popular kitchen appliances.

Certified Cyber Crime Investigator Course Launched by Centre for Police Technology

Clean energy gets a decisive push. To accelerate electric mobility, the government has cut taxes on raw materials used to manufacture lithium-ion cells, a key input for electric vehicle batteries. The measure is expected to reduce battery costs over time, improving affordability for electric cars and two-wheelers. Similarly, inputs used in making solar cells and panels have been granted duty reductions, lowering installation costs for rooftop solar and supporting India’s renewable targets.

Leather and sports goods join the ‘cheaper’ basket. Reduced duties on raw leather and allied inputs are set to make shoes, bags and leather apparel more affordable, benefiting both consumers and export-oriented manufacturers. In a nod to grassroots sport, customs duty cuts on sports equipment should ease prices of items ranging from cricket bats to tennis racquets, encouraging wider participation.

On the other side of the ledger, alcohol becomes costlier. Higher excise collections by states, combined with a firmer central stance, are expected to push up prices across segments. Premium spirits and imported wines will feel a sharper pinch due to higher applicable taxes, a move aligned with the government’s broader public-health messaging.

Tobacco products face a steep hike. Fresh excise duties and cess on cigarettes and pan masala could lift retail prices by an estimated 20% to 40%, according to trade assessments. The intent is clear: discourage consumption of harmful products while boosting revenues.

Luxury imports are not spared. Customs duty has been raised on imported luxury watches, making international brands more expensive. The policy seeks to promote domestic premium watchmaking while placing a higher tax burden on discretionary spending by the affluent.

Market speculation gets pricier. To curb excessive risk-taking in derivatives, the budget revises the framework for stock options and futures trading, including changes to securities transaction tax and capital gains treatment. For retail traders, especially small investors, participating in the F&O segment will now involve higher costs.

Bottom line: Budget 2026 channels relief toward essentials and future-facing sectors—healthcare, manufacturing and clean energy—while deliberately raising the cost of products and activities seen as harmful or speculative. For households, the impact will be visible at pharmacies, electronics stores and EV showrooms, even as nights out, tobacco purchases, luxury splurges and high-risk trades demand a bigger outlay.

About the author – Rehan Khan is a law student and legal journalist with a keen interest in cybercrime, digital fraud, and emerging technology laws. He writes on the intersection of law, cybersecurity, and online safety, focusing on developments that impact individuals and institutions in India.