New Delhi — In a significant shift that underscores the growing complexity of India’s financial and digital ecosystem, the Reserve Bank of India has opened the doors of the central bank to private-sector and specialist talent, announcing a large-scale lateral recruitment drive for 2026. The move reflects a recalibration of how the country’s most powerful financial institution equips itself to oversee an economy shaped increasingly by technology, data, cyber risk and global capital flows.

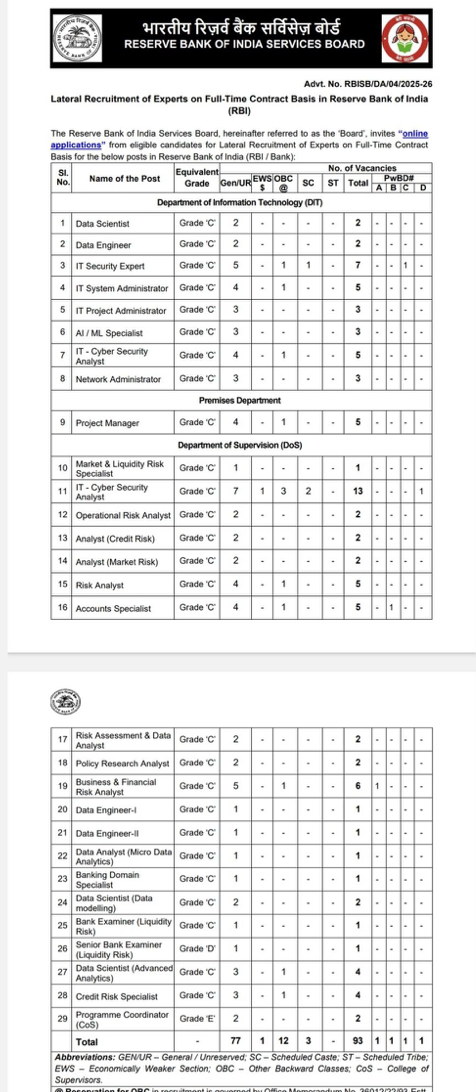

With 93 contractual positions notified across supervision, information technology and infrastructure management, the recruitment marks one of the RBI’s most expansive efforts in recent years to bring domain specialists directly into its regulatory and operational core.

A Central Bank Responding to a Changing Financial Landscape

For decades, the RBI’s institutional strength has rested on a cadre-based system that draws heavily from internal promotions and traditional examinations. But officials and policy watchers say that model is under strain as the financial system grows more sophisticated, digitised and interconnected.

The 2026 lateral recruitment notification, issued through the Reserve Bank of India Services Board, signals an acknowledgment that modern supervision now demands skills not easily cultivated within conventional bureaucratic pipelines. Cybersecurity threats, algorithm-driven trading, AI-led analytics and complex risk modelling have become central to the RBI’s mandate, stretching beyond classical monetary policy and banking oversight.

Applications for the posts opened on December 17, 2025, and will remain live until January 6, 2026, with selection based on shortlisting and interviews rather than written examinations — a further departure from tradition.

FCRF Academy Opens Call for Compliance, Governance and Cybersecurity Trainers

Supervision Takes Centre Stage

A substantial share of the 93 vacancies fall under the Department of Supervision, the RBI’s frontline unit for monitoring banks, non-banking financial companies and systemic risks. The range of roles — spanning credit risk, market and liquidity risk, operational risk and data analytics — highlights how regulatory oversight has become as much about interpretation of data as it is about rule enforcement.

Positions such as cyber security analysts, data scientists, risk assessment specialists and senior bank examiners point to a regulator increasingly focused on pre-emptive risk identification rather than post-crisis intervention. The emphasis on analytics-driven supervision mirrors global regulatory trends, particularly among central banks grappling with fintech expansion and shadow banking risks.

Technology and Data Move to the Core of Governance

The recruitment drive also reflects the RBI’s expanding technological footprint. Under the Department of Information Technology, the central bank is seeking data scientists, AI and machine learning specialists, network administrators and IT security experts.

These roles are not peripheral. RBI officials have repeatedly underscored that payment systems, digital lending platforms and financial infrastructure are now as critical to stability as traditional banking institutions. The demand for specialists in advanced analytics and cyber defence suggests growing concern over vulnerabilities in digital finance, particularly as India’s transaction volumes surge and real-time payment systems scale rapidly.

Preparing for DPDP Enforcement: How FCRF’s CDPO Program Is Shaping India’s Privacy Readiness

By hiring specialists on full-time contractual terms, the RBI appears to be prioritising agility — the ability to plug skill gaps quickly without waiting for long training cycles.

A Broader Signal to India’s Regulatory Ecosystem

Beyond the immediate vacancies, the 2026 recruitment carries a larger institutional message. It reflects a quiet but meaningful shift in how elite public institutions view expertise — no longer as something developed exclusively in-house, but as something that can be sourced from the market when governance demands evolve faster than bureaucracy.

For experienced professionals in technology, risk management and financial analytics, the move opens a rare pathway into policymaking and regulation at the highest level. For the RBI, it is an experiment in blending institutional continuity with external knowledge.

Whether this lateral infusion of talent reshapes the central bank’s internal culture remains to be seen. But as India’s financial system grows more complex and globally integrated, the RBI’s decision suggests a recognition that safeguarding stability may now require skills forged as much outside Mint Street as within it.