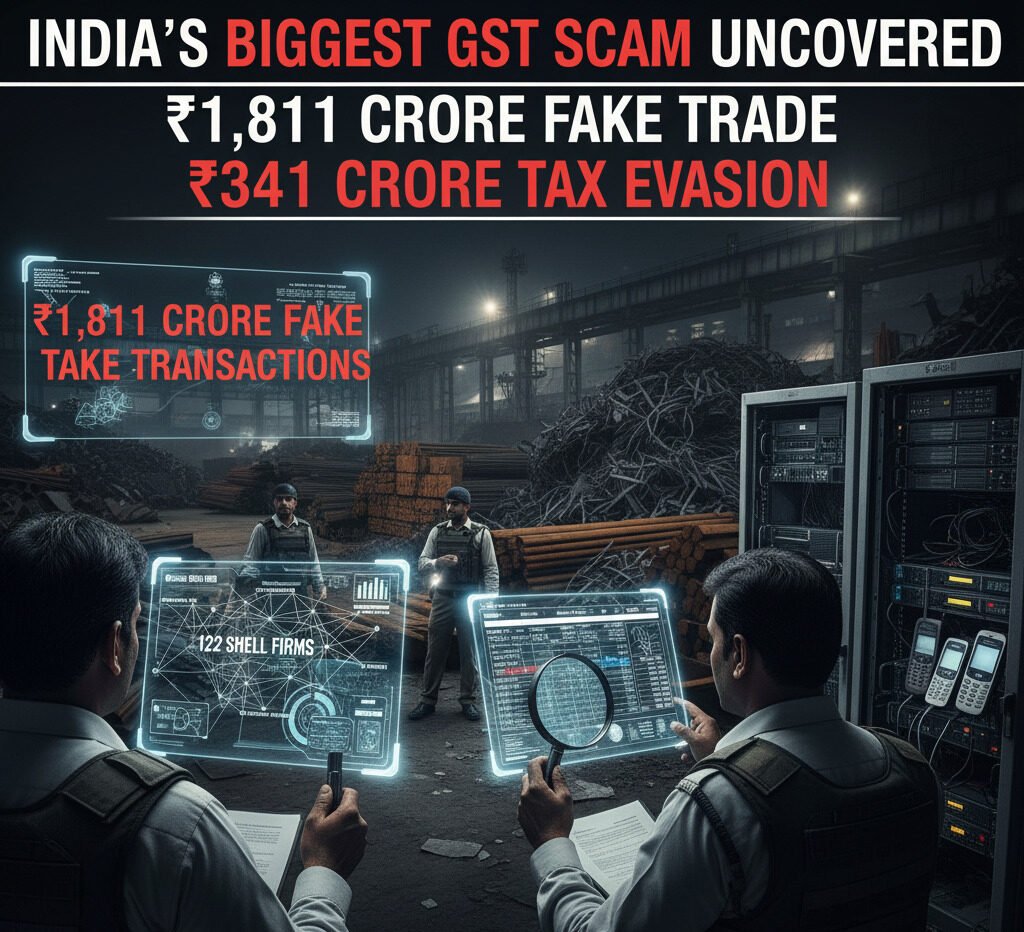

Lucknow / Moradabad | Bureau Report – In a massive crackdown on organized tax fraud, the Uttar Pradesh State Tax Department has uncovered India’s largest GST evasion racket in the iron trade, exposing ₹341 crore in unpaid taxes and ₹1,811 crore in fake transactions.

Investigators revealed that just two mobile numbers were used to register 122 shell firms across multiple states, all part of a network masterminded by Lucknow-based iron trader Ankit Kumar.

A total of nine individuals have been booked, and authorities have initiated proceedings to cancel all 122 bogus firm registrations involved in the scam.

Two Mobile Numbers, One National Fraud Network

The investigation found that Ankit Kumar orchestrated an elaborate operation using only two mobile numbers to create a web of 122 fictitious firms, each registered under the Central and State GST systems.

These firms collectively reported a paper turnover of ₹1,811 crore, while no real business activity ever occurred. The scam came to light after two iron-laden trucks were intercepted on the Lucknow–Moradabad Highway on October 24 and 25.

During questioning, the drivers confessed that the shipment belonged to Ankit Kumar of Rajajipuram, Lucknow, and was being sent to Muzaffarnagar — triggering a full-scale investigation.

Fake Addresses, False Documents, and Phantom Firms

A 42-member investigation team led by Additional Commissioner (Grade-II) R.A. Seth found that Ankit had submitted fabricated addresses and forged identity proofs to register firms with the CGST and State Tax departments.

He falsely claimed to be a tenant at a house in Rajajipuram Awas Vikas Colony, owned by Praveen Kumar Srivastava, who later confirmed he had never rented out the property. Following this revelation, Srivastava filed a complaint at the Tal Katora police station.

Scale of the Scam: How the Numbers Stack Up

- 72 firms registered under the Central GST committed ₹1,274.1 crore worth of fake trade.

- 50 firms under State jurisdiction recorded ₹537.2 crore in bogus transactions.

- The total tax evasion identified amounts to ₹341 crore.

“This is the biggest GST evasion case uncovered to date,” said Additional Commissioner (Grade-I), Moradabad Zone.

A detailed report has been submitted to Principal Secretary (State Tax) M. Devaraj, the State Tax Commissioner, and the Principal Commissioner of CGST for further action.

A Trail That Leads Beyond Borders

Investigators have indicated that the iron trade tax evasion network extends as far as Dubai, hinting at links to hawala transactions and offshore accounts.

Given the scale and sophistication of the operation, Principal Secretary M. Devaraj ordered a 72-hour intensive probe by the Moradabad unit. The inquiry exposed the syndicate’s nationwide reach, preventing a significant loss of government revenue.

“This is the largest GST evasion ever detected.”

-Additional Commissioner (Grade-I), State Tax Department, Moradabad.