A growing cybercrime epidemic, widely known as “pig butchering,” has defrauded billions of dollars from victims worldwide, exploiting vulnerabilities heightened during the Covid-19 pandemic. These schemes rely on fake investment platforms and emotional manipulation, targeting victims under the guise of friendships or romantic relationships. Alarmingly, this criminal enterprise has been linked to human trafficking networks operating in Southeast Asia. Central to these allegations is Wan Kuok-koi, also known as “Broken Tooth,” a former Macau gangster reputedly tied to scam operations, according to a report by The Wall Street Journal. Despite his alleged connections to organized crime, Wan remains free, exposing gaps in global enforcement efforts.

A Short Intro – Wan Kuok-koi: From Triad Boss to Alleged Cybercrime Architect

Widely recognized by his nickname “Broken Tooth Koi“, is a Macau-based businessman and former leader of the 14K triad’s Macau faction. After serving over 14 years in prison, he was released in December 2012. In the subsequent years, Wan has been linked to illicit gambling ventures in Myanmar, as well as activities associated with drug production and transnational organized crime in the Golden Triangle region of Southeast Asia. In 2018, Wan founded the Hongmen Association in Cambodia, ostensibly as a cultural organization but allegedly linked to cybercrime.

The Hongmen Association’s reach extended into Myanmar with the establishment of the Dongmei Zone, reportedly one of the earliest scam compounds. A 2020 ribbon-cutting ceremony saw Wan publicly associating with militia members, solidifying the zone’s reputation as a hub for human trafficking and cyber scams. The U.S. Treasury Department subsequently sanctioned the Dongmei Zone, citing its role in exploiting human trafficking victims and perpetrating digital fraud.

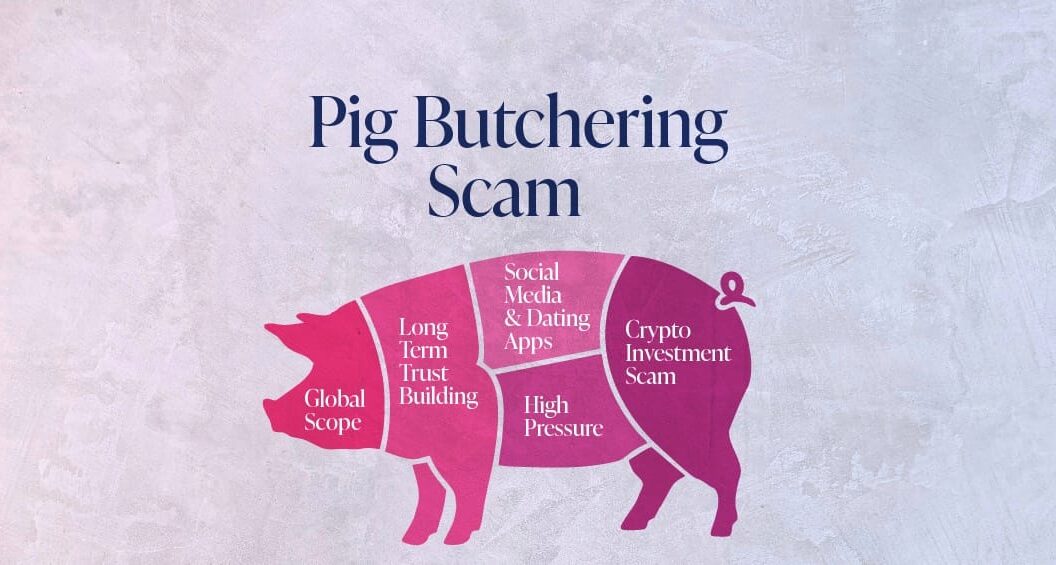

How Pig-Butchering Scams Work

The term “pig butchering” metaphorically describes the method of “fattening” victims through prolonged trust-building before financially “butchering” them. Scammers, often posing as potential friends or romantic partners on social media, lure victims into investing in fraudulent cryptocurrency platforms. The financial losses are staggering. In one case, a Kansas banker embezzled $47.1 million from his own institution to recover his losses. Research by finance professor John Griffin reveals that over a four-year span, criminal networks funneled more than $75 billion through cryptocurrency exchanges, with Tether emerging as a primary tool for laundering these funds.

“These are massive, well-organized criminal networks operating with little interference,” Griffin stated, emphasizing the sophistication and scale of these scams.

Human Trafficking and Exploitation

Investigators have uncovered chilling evidence of thousands of individuals being trafficked into scam compounds like Dongmei under false promises of legitimate work. Victims are often stripped of their passports, forced to create fake online profiles, and coerced into scamming under constant surveillance. One survivor, Lu Yihao, described his harrowing experience of being enslaved in Dongmei for seven months: “From my perspective, Dongmei was specifically built for criminal purposes.”

The United Nations estimates that over 200,000 people remain trapped in such compounds across Southeast Asia, highlighting the dire human cost of these operations.

Enforcement Gaps and the Role of Cryptocurrencies

Despite sanctions and ongoing investigations in countries such as Malaysia, Thailand, and Cambodia, law enforcement efforts have been fragmented and hindered by jurisdictional challenges and limited resources. The growing reliance on cryptocurrencies further complicates these efforts. Platforms like Tokenlon have been identified as tools for laundering proceeds, and while major exchanges like Binance have collaborated with authorities to freeze fraudulent accounts, the scale of operations continues to overwhelm enforcement mechanisms.

“Money from victims in the United States flows directly into the underground economy in Southeast Asia,” noted Jan Santiago, a consultant with the Norwegian firm Chainbrium, in an interview with Time. Cryptocurrencies, while offering traceability, remain a favored tool for illicit activities due to their global reach and pseudo-anonymity.

A Pandemic-Driven Perfect Storm

The Covid-19 pandemic created ideal conditions for pig-butchering scams to thrive, with isolated individuals becoming more vulnerable to scammers posing as confidants. Victims not only lost life savings but also experienced emotional and psychological devastation. A recent study titled How Do Crypto Flows Finance Slavery? The Economics of Pig Butchering underscored the global scale of these operations. Tether’s CEO, Paolo Ardoino, defended the platform, stating, “Every action is traceable, every asset can be seized, and every criminal can be caught,” but critics argue that cryptocurrencies remain an enabler of transnational crime.

Wan’s Denial and Public Appearances

Despite mounting allegations, Wan has consistently denied any involvement in illegal activities. In a 2020 video flanked by Chinese national and Communist Party flags, he asserted that his Hongmen Association “follows the law.” A statement attributed to the organization claimed that Wan had “retired from the underworld” to focus on legitimate business ventures. However, Wan continues to appear in videos tied to Hongmen initiatives, including the recent opening of a Macau office. His exact whereabouts remain elusive, with investigations stalling in Macau, Hong Kong, and Kuala Lumpur.