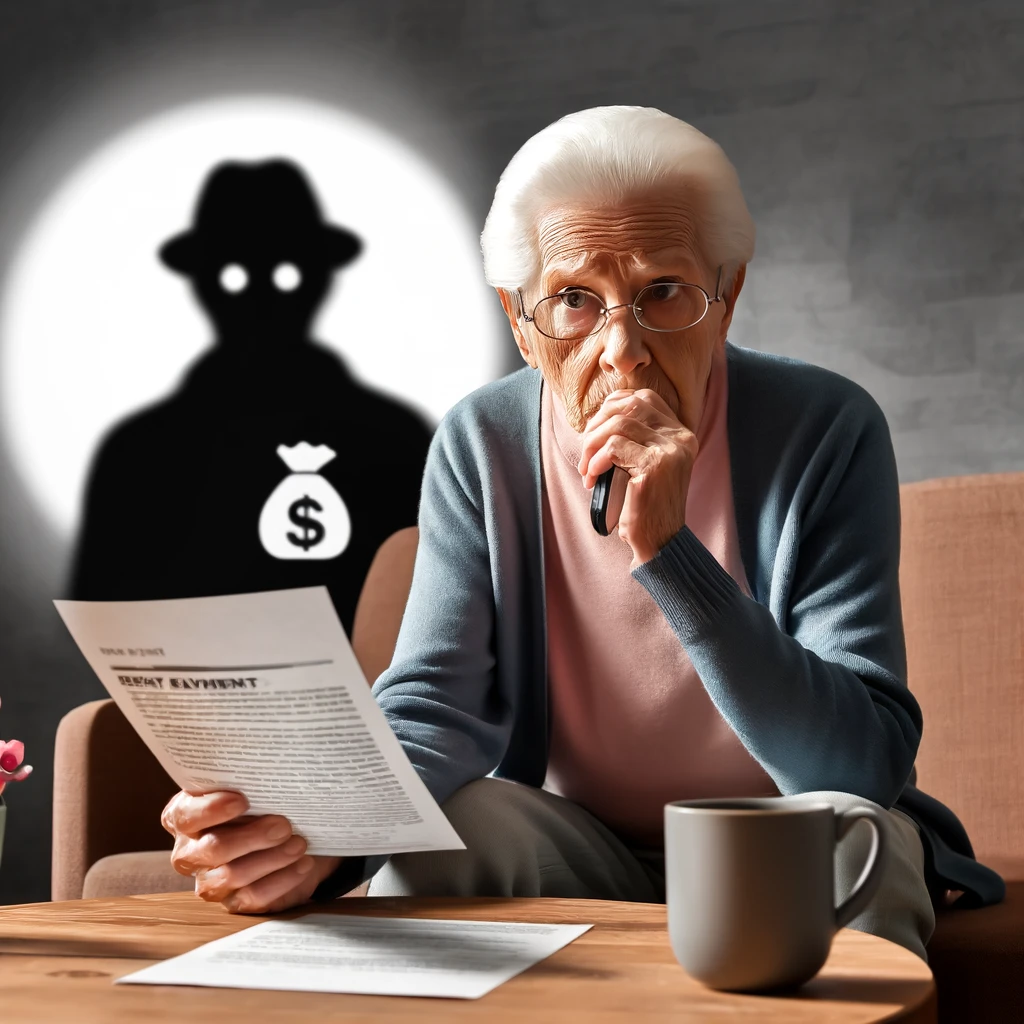

Noida: In a disturbing trend that exploits the trust of elderly landlords, a gang operating under the guise of Indian Army officers has been systematically defrauding unsuspecting victims through popular real estate platforms 99Acres.com, OLX, and Magic Bricks. Despite the availability of data privacy solutions, personal contact information is being mishandled, leading to these rampant scams.

The criminals involved have been identified through their consistent use of multiple phone numbers, including those listed as belonging to ‘Bijay Kumar’, ‘Randip Singh’, and ‘Deepak Pawar’. These individuals contact landlords, particularly targeting the elderly, who are more vulnerable to such deceit.

Modus Operandi

The gang’s modus operandi involves a well-crafted scheme to earn the trust of their targets. Initially, the scammers make small goodwill payments, usually between Rs. 100 and Rs. 500, to ‘check’ if the money is going into the Landlord’s account only. This small investment serves to lower the guard of the unsuspecting landlords.

Following these transactions and gaining some trust, the criminals send a UPI QR code to the landlords. They are instructed that scanning the code and entering their UPI pin will result in the receipt of the full rental payment. However, once the pin is entered, the victim’s bank account is accessed, and funds are quickly siphoned off. Subsequently, the scammers block any further communication, leaving the landlords defrauded and distressed.

To protect against rental scams like the one targeting elderly landlords on platforms like 99Acres and OLX, both individuals and platforms can take several preventive measures:

For Individuals:

- Verify Identities: Always confirm the identity of potential tenants through multiple means. Request government-issued IDs and verify them with appropriate authorities if possible.

- Be Skeptical of Overpayments: Be cautious of tenants who make payments that exceed the agreed amount, especially if they then request a refund of the excess.

- Avoid Sharing Personal Financial Details: Never share your bank account numbers, PINs, or any other sensitive financial information over the phone, email, or messaging apps.

- Use Secure Payment Methods: Encourage payments through verified, secure, and traceable methods. Avoid accepting payments through unfamiliar or potentially insecure platforms, especially those that involve QR codes for direct bank access.

- Educate Yourself on Digital Transactions: Learn how different payment and transaction methods work, including the risks associated with each. Knowing what a secure transaction looks like can help avoid scams.

ALSO READ: You Won’t Believe What Customs Found Inside These Liquor Boxes at IGI Airport!

For Platforms:

- Enhanced Verification Processes: Implement stronger verification processes for users who list properties and those who respond to listings. This might include requiring additional documentation or conducting background checks.

- Secure Payment Gateways: Provide or integrate secure payment systems that allow transactions to be held in escrow until both parties confirm the terms of the agreement have been met.

- Fraud Detection Algorithms: Utilize advanced algorithms to detect unusual user behavior, repeated use of the same contact information under different names, or other indicators of potential fraud.

- User Education Programs: Regularly educate users on the latest types of scams and the safest practices for online transactions through workshops, articles, and alerts.

- Rapid Response Teams: Establish dedicated teams to handle reports of suspicious activity quickly, offering immediate support to users who might be victims of a scam.

- Data Privacy Enhancements: Strengthen data protection measures to ensure that user information is not easily accessible to potential scammers, complying with the latest data protection regulations.