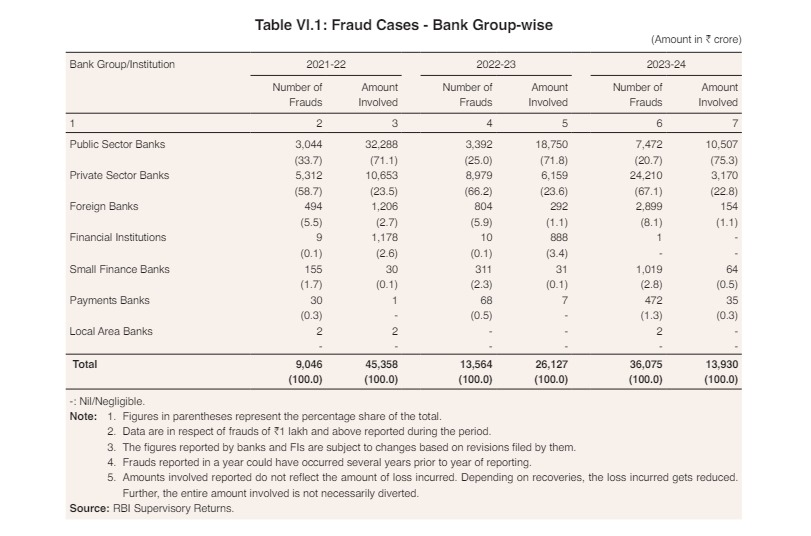

Mumbai: RBI has released its annual report for the fiscal year 2023-2024, presenting a comprehensive analysis of fraud cases across different bank groups. The report indicates a remarkable 46.7% decline in the total amount involved in frauds compared to the previous year, even when the absolute amount of cases has more than doubled.

Bank Group-Wise Fraud Assessment:

– Over the last three years, private sector banks have consistently reported the highest number of fraud cases. Despite this, public sector banks continue to contribute the most in terms of the total fraud amount.

– Frauds in private sector banks predominantly involved small-value card and internet transactions. In contrast, public sector banks faced significant frauds primarily in their loan portfolios.

ALSO READ: Is India Inc. Ready for the DPDP Act 2023? Join the Webinar by Future Crime Research Foundation

Types of Frauds:

– The majority of frauds by volume occurred in the digital payments category, including card and internet frauds.

– In terms of value, the most significant frauds were reported in the loan portfolio, particularly in the advances category.

Fraud Amount and Detection Time-Lag:

– The total amount involved in frauds reported during 2023-24 saw a substantial decrease, falling to Rs 13,930 crore from Rs 26,127 crore in 2022-23.

– There is a notable time-lag between the occurrence and detection of frauds. For instance, 94% of the fraud amount reported in 2022-23 and 89.2% in 2023-24 were related to frauds that occurred in previous financial years.

ALSO READ: Ransomware Attack Compromises Data at Medical Device Manufacturer LivaNova: Complete Details Inside

Future Initiatives:

The RBI has outlined several goals for the fiscal year 2024-25 under its Utkarsh 2.0 agenda:

– Cyber Range Setup: To enhance the cyber incident response capability of Scheduled Commercial Banks (SCBs).

– Supervisory Capabilities Enhancement: Implementation of a suite of SupTech data tools leveraging artificial intelligence (AI) and machine learning (ML) for micro-data analytics and other use cases.

The RBI’s focused efforts on reducing fraud amounts and improving detection mechanisms are evident in the report. The planned initiatives for 2024-25 aim to further strengthen the banking sector’s resilience against frauds, ensuring a safer and more secure financial ecosystem.

Also to be noted, that in the first four months of 2024, Indians faced significant losses amounting to over Rs 1,750 crore due to cybercrime activities. The National Cybercrime Reporting Portal, managed by MHA, recorded more than 740,000 complaints between January and April 2024. The Indian Cyber Crime Coordination Centre (I4C) reported an average of 7,000 cybercrime complaints per day in May 2024. This represents a staggering 113.7% increase.

Follow The420.in on

Twitter (X), LinkedIn, and YouTube