NEW DELHI: A recent white paper by CloudSEK projects that India will suffer a staggering financial loss of approximately Rs 20,000 crore due to cybercrime in 2025. The research highlights brand abuse and fake domains as major contributors to this economic impact, with brand impersonation alone accounting for nearly Rs 9,000 crore of the projected losses.

The findings highlight a sharp spike in cyber threats, fueled by the country’s increasing digital adoption. As cybercriminals refine their tactics, Indian businesses, regulatory bodies, and consumers face mounting challenges in mitigating digital fraud.

CloudSEK’s study builds upon data from the Indian Cyber Crime Coordination Centre (I4C), which reported cybercrime losses of Rs11,333 crore in the first nine months of 2024. By applying advanced predictive models, researchers estimate an alarming 76.5% increase in cybercrime losses in 2025.

Key statistics from the report:

- Over 2.5 million cybercrime complaints are expected in 2025.

- 45% of total losses will stem from brand abuse and fake domains.

- The banking and financial services sector will suffer the most, accounting for 41% of the losses (Rs8,200 crore).

- Fraudulent domains and apps are projected to increase by 65% and 83% respectively.

Nominations are open for Honouring Women in Cyberspace on International Women’s Day 2025- Nominate Now!

Brand Abuse: A Silent but Costly Cybercrime

Brand impersonation scams involve cybercriminals creating fake websites, mobile apps, and social media pages that mimic trusted brands. These fraudulent platforms deceive users into sharing personal and financial information, leading to significant financial and reputational damage.

High-Profile Cases Highlight the Growing Risk

- A Pune-based chartered accountant lost Rs3.4 crore in a scam exploiting a British firm’s name.

- Fraudsters impersonating a major airline attempted to defraud a consumer of Rs15,600.

The report notes that banks, e-commerce companies, and government services are among the most targeted industries, with large banks detecting an average of 175 fraudulent apps per year.

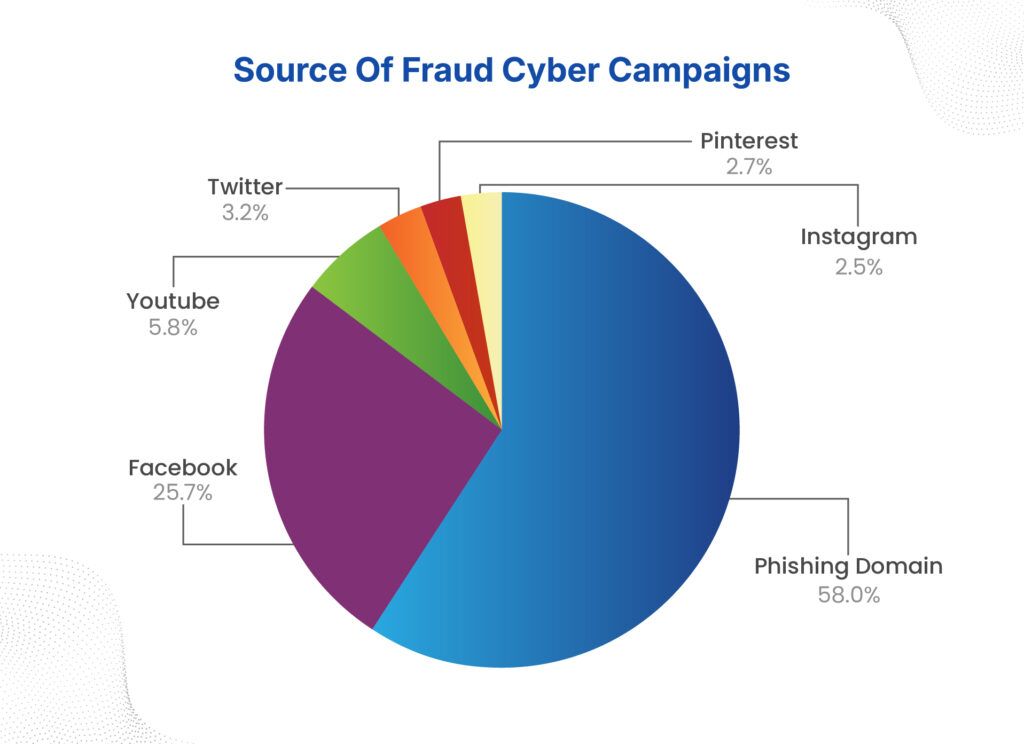

CloudSEK’s investigation reveals that phishing domains remain the leading source of fraudulent campaigns, followed by malicious mobile applications. Key types of cyber fraud include:

- Investment Scam Apps: Circulated via YouTube and Telegram, these non-malicious apps use brand names to lure victims.

- Bank KYC/Reward Apps: Designed to harvest banking details while capturing SMS data for unauthorized transactions.

- Fake Bill Payment Apps: Mislead users into entering payment details for fictitious services.

The banking, retail, and government sectors will bear the brunt of cybercrime-related financial damage:

- Banking & Financial Services: Rs8,200 crore (41% of total losses)

- Retail & E-Commerce: Rs5,800 crore (29%)

- Government Services: Rs3,400 crore (17%)

- Other Sectors: Rs2,600 crore (13%)

Additionally, consumer financial losses alone are estimated to reach Rs14,000 crore, while organizations will incur Rs6,000 crore in remediation, legal, and cybersecurity costs.

Strategic Recommendations to Combat Cybercrime

To counter the growing cyber threats, organizations must implement proactive measures. One of the key strategies is brand monitoring, which involves detecting and mitigating fake domains and fraudulent applications before they can harm consumers. Additionally, organizations need to establish swift takedown protocols to expedite the removal of malicious websites and applications, minimizing potential damage. Raising consumer awareness through targeted campaigns can also play a crucial role in helping individuals identify and avoid cyber fraud. Furthermore, cross-industry collaboration is essential, as sharing threat intelligence across sectors can strengthen collective defenses against cybercrime.

Regulatory bodies also have a significant role to play in enhancing cybersecurity. Strengthening cybercrime response mechanisms, particularly during the “golden hour”—the critical first moments after a fraud is detected—can increase the chances of mitigating financial loss. Given the transnational nature of cybercrime, cross-border crackdowns should be prioritized to track and dismantle international cybercriminal networks. Additionally, holding digital platforms accountable by enforcing stricter regulations on online content hosting can help curb the spread of fraudulent activities.

Consumers, as the primary targets of cyber fraud, must adopt best practices to safeguard their digital presence. Verifying digital communications, including websites, apps, and links, before engaging with them is crucial to avoid falling victim to scams. In case of suspicious activity, individuals should promptly report cyber fraud by contacting the national cybercrime helpline (1930) to initiate immediate action. Moreover, adopting strong security practices such as multi-factor authentication and robust password management can significantly reduce the risk of cyber threats.

The projected Rs20,000 crore cybercrime highlights the threat the Indian economy faces. As cyber threats continue to evolve, proactive countermeasures can help mitigate financial and reputational damage.

CloudSEK’s research underscores the importance of brand protection in reducing cyber risks. A coordinated effort involving businesses, regulatory authorities, and consumers is essential to strengthening India’s defenses against increasingly sophisticated cyber threats. By implementing robust cybersecurity strategies, the nation can build a more resilient digital ecosystem and protect its citizens from financial exploitation.