In a major development that has sent shockwaves through India’s corporate ecosystem, the Ahmedabad bench of the National Company Law Tribunal (NCLT) on Wednesday issued a series of strict directives against Gensol Engineering Ltd, its related entities, and top executives, following serious allegations of financial misconduct and corporate fraud.

The tribunal, acting on a report highlighting the diversion of funds, falsified financial statements, and violation of company law provisions, ordered the freezing of bank accounts and assets belonging to 37 individuals and organizations connected to Gensol. This includes promoters Anmol Singh Jaggi and Puneet Singh Jaggi, who are alleged to have misused company funds for personal gain, transferred assets without legal approvals, and misrepresented loan defaults.

The Reserve Bank of India (RBI) and the Indian Banks’ Association (IBA) have been directed to freeze all domestic and international bank accounts and lockers of the accused parties. Simultaneously, the court has prohibited the sale, mortgage, or transfer of any movable or immovable assets belonging to Gensol, its associates, and promoters—whether in India or abroad.

ALSO READ: FCRF Launches Campus Ambassador Program to Empower India’s Next-Gen Cyber Defenders

Multi-Agency Investigation Begins: MCA, SEBI, SFIO, and Income Tax Department Step In

Due to the scale and seriousness of the suspected fraud, multiple regulatory bodies have launched parallel investigations. These include:

- Ministry of Corporate Affairs (MCA)

- Securities and Exchange Board of India (SEBI)

- Serious Fraud Investigation Office (SFIO)

- Reserve Bank of India (RBI)

- Income Tax Department

The MCA has been granted legal authority to collaborate with Indian embassies worldwide to enforce the tribunal’s orders, ensuring that assets and accounts held by the accused abroad are also scrutinized and brought under regulatory oversight.

Additionally, the MCA has been instructed to alert the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) to halt share trading activities by Gensol and its promoters, effectively curbing any attempts to liquidate holdings amid the probe.

Furthermore, CDSL and NSDL—India’s central securities depositories—have been directed to freeze all electronic securities held by the accused, preventing the disposal of stocks or bonds that may be linked to the alleged financial wrongdoing.

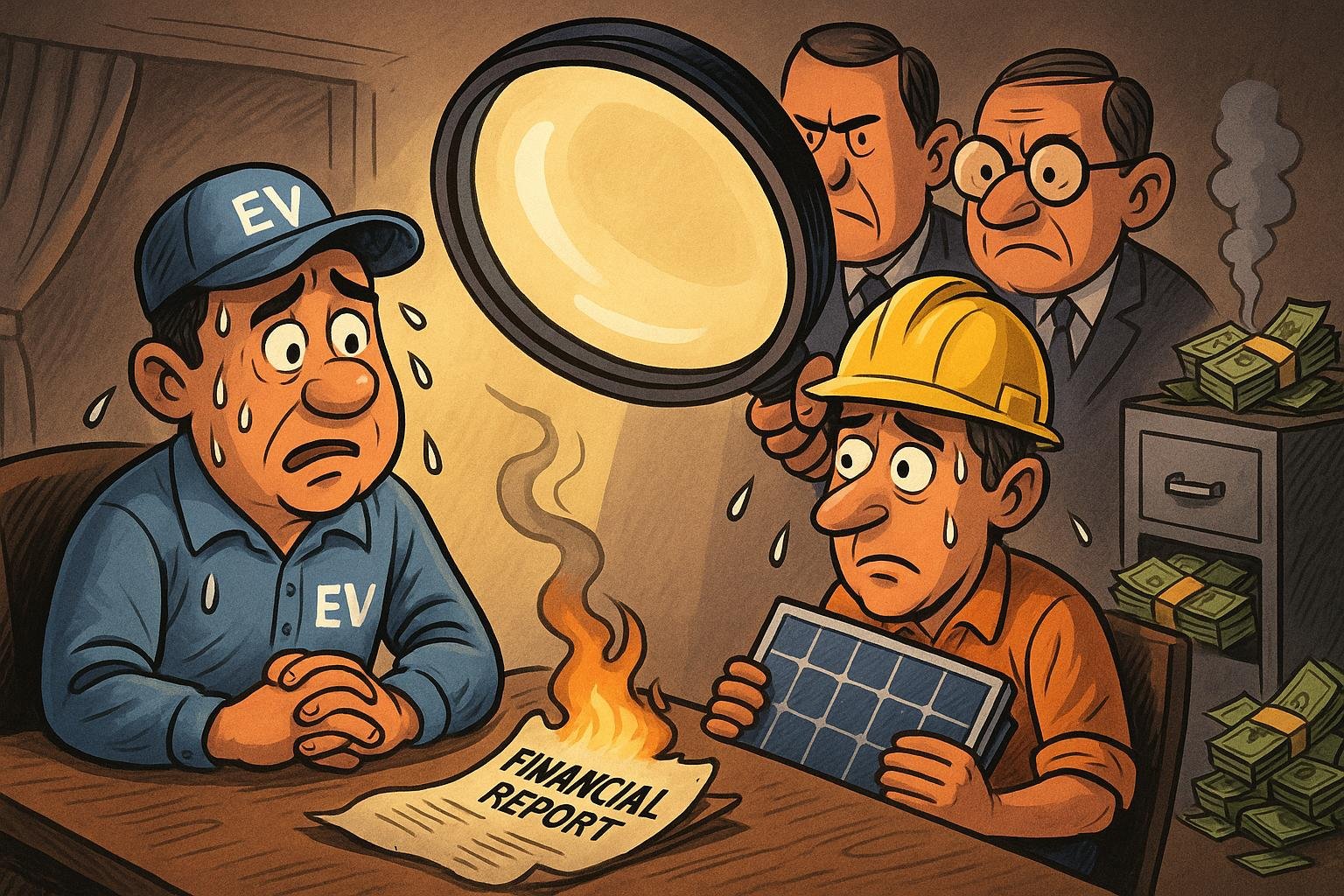

₹975 Crore Loan Misused? Court Flags Large-Scale Diversion in EV Business

The NCLT has taken special note of preliminary findings indicating that nearly ₹975 crore in loans—which were purportedly sanctioned for Gensol’s electric vehicle (EV) ventures—may have been siphoned off or misappropriated. These funds, instead of being used for legitimate business development, appear to have been diverted for personal use or redirected through complex intra-group transactions.

Promoters are also accused of masking loan defaults while continuing to secure further funding. Regulators now suspect that this could be a large-scale corporate fraud with significant implications for lenders, shareholders, and public investors.

The tribunal emphasized that these actions were necessary to protect public interest, ensure corporate accountability, and prevent further erosion of shareholder value and public trust in the wake of the evolving scandal.

Gensol Case Sets New Precedent in Corporate Accountability

The aggressive response by the NCLT and various enforcement agencies signals a no-tolerance approach toward white-collar crime, especially in sectors involving public funds and emerging industries like electric mobility.

With assets frozen, multiple agencies engaged, and legal proceedings underway, the Gensol case may become a benchmark for corporate fraud detection and enforcement in India. As the investigations continue, industry observers await further revelations that could widen the scope of accountability and strengthen regulatory checks in India’s corporate governance ecosystem.