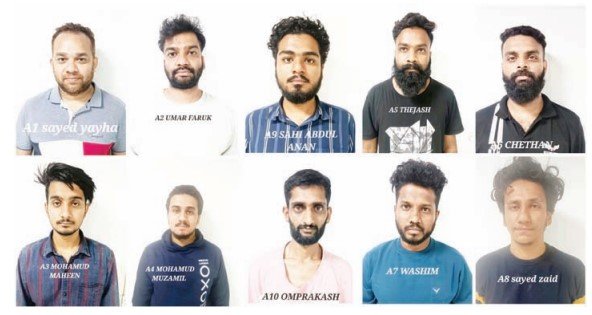

BENGALURU: The Bengaluru City Police’s North Division has arrested 10 individuals involved in a cryptocurrency trading scam that duped victims into investing lakhs of rupees. The operation comes after a complaint of Rs 25,37,815/- was filed, accusing the culprits of running a fake cryptocurrency trading and investment platform.

The investigation revealed a complex web of transactions, with the accused using mule bank accounts to funnel and hide the money. Three of the accused were apprehended at the airport while returning from China, where they had met with the masterminds behind the scam. The other seven individuals were operating mule bank accounts, crucial for laundering the stolen money.

What Was Seized During the Operation?

The police’s investigation led to the seizure of:

- 133 SIM cards

- 182 debit cards

- 127 bank passbooks

- 72 mobile phones

- 2 laptops

- Rs 1,74,000 in cash

This haul provided crucial evidence, helping the police trace the money flow across various accounts. Further investigation into these seized bank passbooks revealed that Rs 7,34,768/- had been frozen in different bank accounts used in the scam. The investigation is still ongoing, with more potential breakthroughs expected.

How the Scam Worked: A Detailed Look at the Modus Operandi

The criminals operated with a well-planned approach that played on people’s trust and curiosity, often using social media to initiate contact. The first point of engagement would typically be through platforms like Facebook and Instagram, where victims would receive seemingly harmless invitations to participate in online tasks—like reviewing luxury hotels. These tasks would often appear to be legitimate, creating an illusion of trust.

Once the victim was comfortable, the conversation would quickly move to more private platforms like WhatsApp or Telegram. At this stage, the criminals would suggest “investment opportunities” in cryptocurrency, promising lucrative returns. The victim in this case was eventually convinced to invest about Rs 25 lakhs across various mule accounts, operated by the scammers.

Mule accounts—bank accounts that are typically opened by individuals who are either complicit or unaware of the fraudulent activities—are a key element in such scams. These accounts, mainly from Karnataka Bank, were used to “layer” the money, distributing it across multiple accounts to make it harder for authorities to trace.

ALSO READ: Join The Movement: Registration Open for ‘Cyber Safe Uttar Pradesh’ Event by FCRF on October 17

A Nationwide Cybercrime Syndicate: Inter-State Links Revealed

The arrests in Bengaluru have opened the door to a much larger investigation, revealing that this was not an isolated incident. The scam is linked to 122 cases reported on the National Cybercrime Reporting Portal, part of the Indian Cyber Crime Coordination Center (I4C) under the Ministry of Home Affairs. This portal is used for reporting and investigating cybercrimes across the country, making it a critical resource for tracking the spread of such fraud.

Even more concerning is the inter-state and transnational nature of the crime. The arrested individuals were part of a network with connections to at least 20 states across India. Here’s a breakdown of some of the cases linked to this network:

- Andhra Pradesh: 10 cases

- Assam: 1 case

- Bihar: 6 cases

- Chandigarh: 1 case

- Chhattisgarh: 3 cases

- Delhi: 3 cases

- Gujarat: 3 cases

- Haryana: 7 cases

- Himachal Pradesh: 1 case

- Karnataka: 9 cases (3 reported in Bengaluru North CEN Police Station)

- Kerala: 2 cases

- Madhya Pradesh: 1 case

- Maharashtra: 12 cases

- Odisha: 2 cases

- Punjab: 4 cases

- Rajasthan: 5 cases

- Tamil Nadu: 20 cases

- Telangana: 12 cases

- Uttar Pradesh: 16 cases

- West Bengal: 3 cases

The fact that the syndicate’s masterminds are believed to be operating out of China adds a layer of complexity to the investigation. The accused individuals traveled to China to meet with these key figures, showing how international networks are being used to facilitate large-scale cyber fraud.

Alarming Impact on India’s Banking and Telecom Sectors

What makes this case particularly alarming is the criminals’ use of fake SIM cards and mule accounts. These tactics highlight significant vulnerabilities in both the banking and telecom sectors in India. By using these methods, scammers can easily move large sums of money across borders and accounts without raising immediate suspicion.

With 133 SIM cards and 127 bank passbooks seized, the operation has exposed the extent to which cybercriminals are able to manipulate systems to their advantage. The involvement of Chinese nationals operating within India’s financial ecosystem is a red flag for both banking institutions and telecom companies, who may now need to rethink their security protocols.

What Happens Next?

The Bengaluru police have made significant headway in this case, but the investigation is far from over. As they continue to interrogate the arrested individuals and analyze the seized devices, more arrests could follow in the coming weeks. Additionally, law enforcement agencies across India are collaborating to trace the kingpins behind this transnational cybercrime.

For now, Rs 7.34 lakh has been frozen across various bank accounts, and the police are actively working with banks to uncover more fraudulent transactions. This case highlights the importance of vigilance in today’s digital world, where cybercriminals are constantly finding new ways to exploit the trust of unsuspecting individuals.

A Wake-Up Call for Crypto Investors

This case is reminder for anyone involved in or considering cryptocurrency investments to be extremely cautious. While the promise of high returns can be tempting, it’s important to verify the legitimacy of any platform or individual offering such opportunities.

Law enforcement agencies urge people to avoid engaging with unknown individuals or schemes that are introduced through social media, especially if they involve cryptocurrency. The ease with which money can be laundered and hidden in digital currencies makes it an attractive option for criminals, but also a risky one for unsuspecting investors.

For now, the Bengaluru police have sent a clear message: Cybercriminals may be able to hide behind fake accounts and SIM cards, but with enough coordination and investigation, they will eventually be brought to justice.