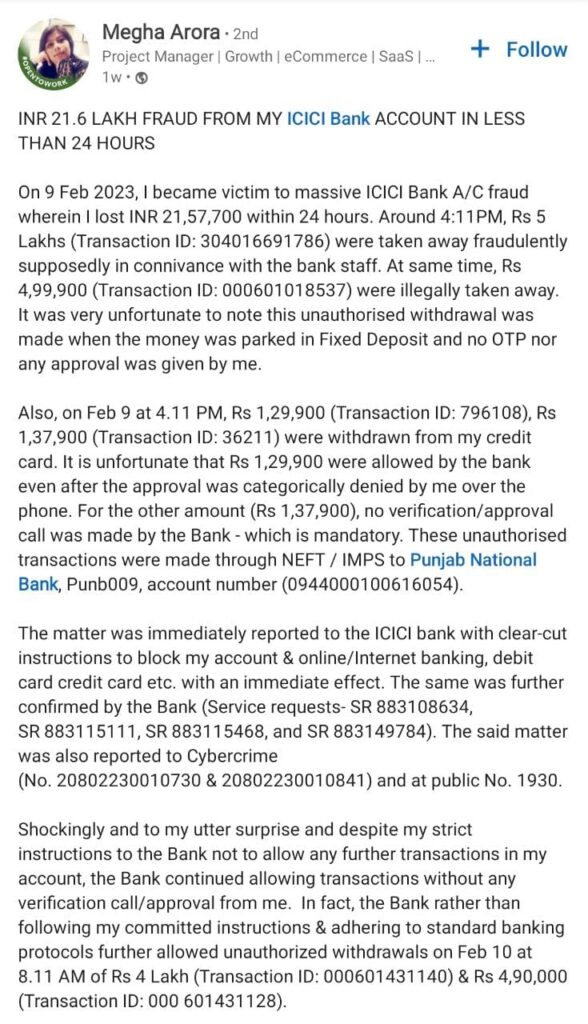

NOIDA: ICICI Bank, one of India’s leading private banks, has been accused of a massive fraud by Megha Arora, a victim who claimed to have lost Rs 21,57,700 from her account in less than 24 hours.

Arora took to LinkedIn to share the unfortunate news and request assistance in spreading the word to urge ICICI Bank to investigate the matter and return the stolen money.

According to Arora’s post, on February 9, 2023, she noticed that Rs 5 lakhs and Rs 4,99,900 had been fraudulently withdrawn from her ICICI Bank account without her approval.

To make matters worse, these unauthorized transactions were made when her money was parked in Fixed Deposit, and no OTP or approval was given by her. Furthermore, she discovered that Rs 1,29,900 and Rs 1,37,900 were withdrawn from her credit card without her consent.

ALSO READ: Over 10 Lakh Cyber Crime Complaints Received By I4C in 2022

Megha Arora, who is a Project Manager at EIT Consulting immediately reported the fraudulent activity to the ICICI Bank, and the bank confirmed that her account had been blocked. She also reported the matter to Cybercrime and the helpline number, but to her shock, the bank continued to allow transactions without her approval.

On February 10, two unauthorized withdrawals of Rs 4 lakhs and Rs 4,90,000 were made from her account, further complicating the situation.

ALSO READ: Step By Step Guide: How To File Cybercrime Complaints Online In India

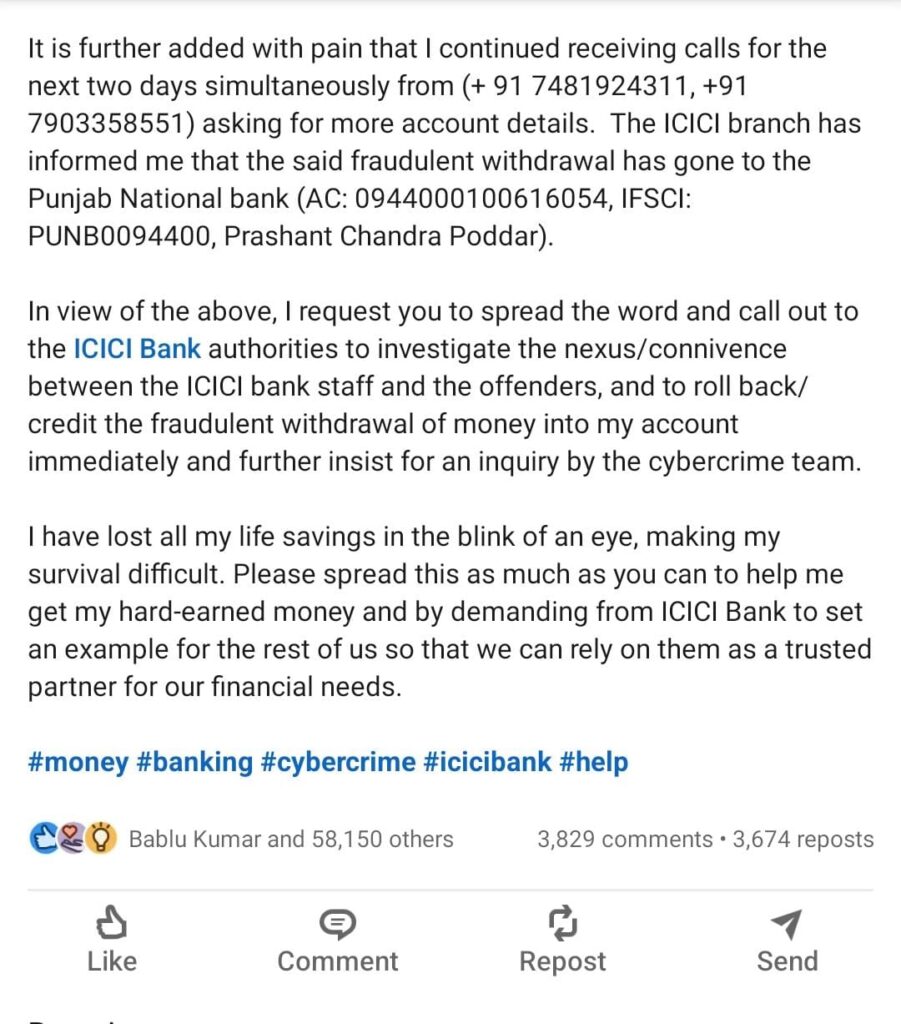

Despite her repeated instructions to the bank not to allow any further transactions, Arora received calls from unknown numbers asking for more account details. The bank branch informed her that the money had been transferred to the Punjab National Bank account of Prashant Chandra Poddar.

Arora has urged the public to help her in spreading the word and pressuring ICICI Bank authorities to investigate the fraud and return her money. She also called for an inquiry by the cybercrime team to identify the nexus/connivance between the ICICI Bank staff and the offenders.

ALSO READ: Want To Become A Future Crime Researcher? Join The Future Crime Research Foundation

“I have lost all my life savings in the blink of an eye, making my survival difficult. Please spread this as much as you can to help me get my hard-earned money and by demanding from ICICI Bank to set an example for the rest of us so that we can rely on them as a trusted partner for our financial needs,” said Arora in LinkedIn post

This unfortunate incident serves as a reminder to all bank account holders to be vigilant and take necessary precautions to safeguard their accounts against fraudulent activities.

Replying to her post ICICI Bank said, “We have started investigating into the matter and we solicit your co-operation for the same. We are also extending our co-operation to the Police investigation.”

The bank said as mentioned in your complaint with Cyber Police, an apk file, which was sent by an unknown person on Feb 9, 2023, was downloaded in your phone. Thereafter, a series of transactions took place through internet banking. Execution of these transactions required entering of confidential information including OTP (sent to your registered mobile phone), ATM/Debit Card PIN, Debit Card Grid and Credit Card PIN. Typically, the responsibility of safekeeping of these information lies with customers and the security features like OTP, PINs are system generated and cannot be read by the Bank employees. You informed us about these transactions a few hours after they took place.

The investigations—by the Police and ICICI Bank— have begun to unearth how the transactions went through. Meanwhile, we are crediting the amount of the transactions that took place after you informed us about the incident.

Follow The420.in on

Telegram | Facebook | Twitter | LinkedIn | Instagram | YouTube